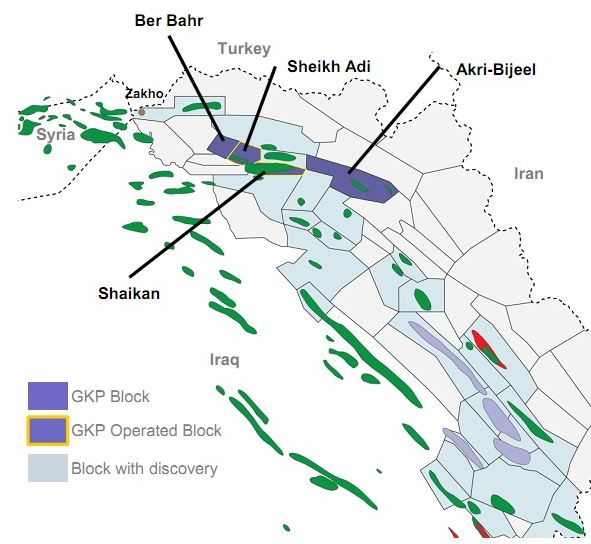

At least one in four children in Iraq impacted by conflict and poverty

At the upcoming Kuwait conference, UNICEF calls for immediate and massive additional investment in education; a key for lasting peace and progress in Iraq

Statement by UNICEF Regional Director, Geert Cappelaere, following his visit to Iraq:

“Iraq today hosts one of UNICEF’s largest operations in the world, responding with humanitarian and development assistance to the needs of the most vulnerable girls and boys across the country.

“More than 4 million children have been impacted by extreme violence in several areas including in Ninewa and al-Anbar. Last year alone, 270 children were killed. Many were robbed of their childhood, forced to fight on the frontlines. Some will bear the physical and psychological scars for life due to exposure to unprecedented brutality. Over 1 million children were forced to leave their homes.

“While the fighting has come to an end in several areas, spikes of violence continue in others. Just this week, three bombings went off in Baghdad. Violence is not only killing and maiming children; it is destroying schools, hospitals, homes and roads. It is tearing apart the diverse social fabric and the culture of tolerance that hold communities together.

“In the northern city of Mosul, a place that witnessed unspeakable destruction, I met children who were hit hard by three years of violence. In one of the schools that UNICEF recently rehabilitated in the western parts of Mosul, I joined 12-year-old Noor in class. She told me how her family stayed in the city even during the peak of the fighting. She spoke of her fear when she was taking shelter. She lost three years of schooling and is now working hard to catch up, learning English with other boys and girls.

“Mankind may have proven once again in Mosul and other parts of Iraq its massive power to destroy and destruct. But another much stronger power left a deeper impression: the determination to rebuild and get on with life. Children were so excited speaking of their aspirations, sharing their happiness of being able to play and study again.