By John Lee.

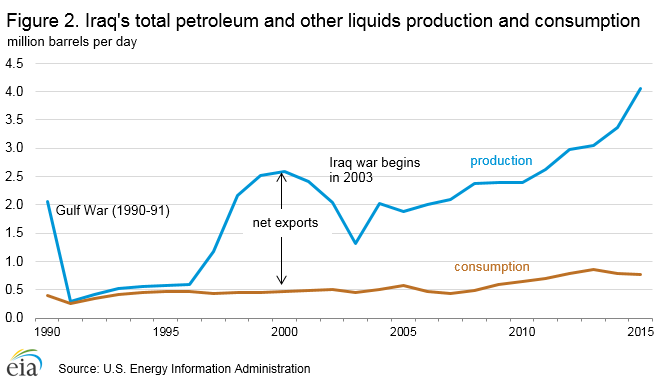

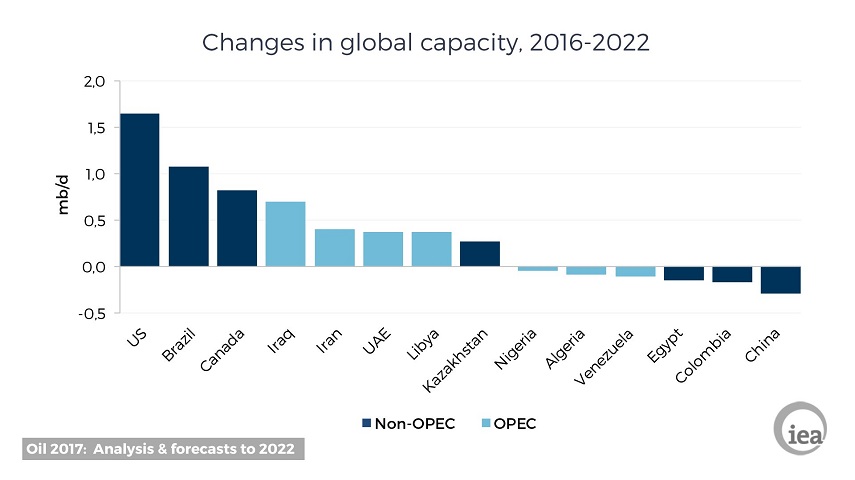

Oil Minister Jabar Ali al-Luaibi [Allibi, Luiebi] (pictured) has said Iraq plans to increase its crude oil production capacity from 5 million bpd at present to 7 million bpd by 2022.

According to a report from Reuters, he added that Iraq needs $4 billion for new investments in its downstream oil industry, lifting refining capacity to 1.5 million bpd by 2021.

It said the increase in refining capacity would come from seven projects, some of them new and some involving the expansion of existing refineries.

(Source: Reuters)