By Ahmed Mousa Jiyad.

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News.

A confused and confusing decision by the Council of Ministers-CoM followed by an imprecise statement from the Ministry of Oil-MoO regarding Iraq-Jordan/ Basra-Aqaba Oil Pipeline-BAOP project had ignited a new wave of serious concerns and protests that eventually led to filing two lawsuits of appeal before the Federal Supreme Court-FSC and, probably, more cases are in the making, but surely the heated debate continues unabated.

To clarify what surrounds BAOP project, a debating platform, Al-Mushtarek, invited me to address the mater; by utilizing Zoom facility and with help of PowerPoint the event was successfully convened.

The topic is, Basra – Aqaba Oil Pipeline: Economic, Legal, Geopolitical, Geostrategic and National Security Perspectives. My purpose is to make independent, professional, constructive, and facts/evidence-based contribution to the national ongoing debate regarding this pipeline.

Throughout my presentation I covered some basic issues before opining the debate by and with the direct participants who are in many different countries and others who posted questions through other social media means, particularly Twitter.

The first issue was “Reality and Implications of Semi Landlocked Geographic Location”.

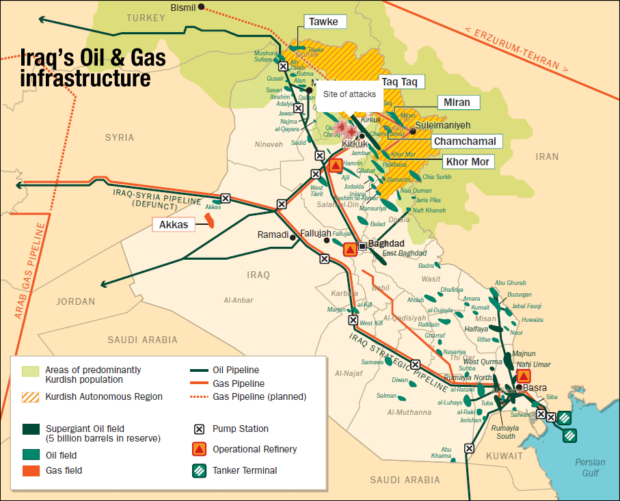

The reality, Iraq is the only Arab resource rich (oil and gas) country that has very narrow access to international waters through north Arabian Gulf; due to its imbalance economic structure, it has high dependency on natural resource, specifically oil, exports revenues, and after almost a century of oil discovery the failed economic policies only deepen such imbalance, making it more chronic and the country as clear example manifesting “Dutch disease” and “Resource curse” effects, exacerbated by devastating kleptocracy of post 2003 invasion.

Geography is sovereign, and thus there are, for Iraq, many implications of relevance to our topic- oil export pipelines.

Each of the neighboring countries, i.e., Jordan, Syria, Saudi Arabia, Turkey possesses a “location rent“; this could be economical and financial (in terms of transit fee, oil supplies or operating the pipeline) and political leverage, competition and interference.

Each export outlet has, simultaneously, geopolitical risks and geostrategic importance and, thus, there are high degrees of associated vulnerability and uncertainty.

The diversity and capacities of oil export outlets through pipelines and seaborne represent an economic rationality problem, i.e., if all oil export outlets are developed, total export capacity would exceed total oil production capacity by many folds.

The above reality and implications are bound to impact Iraqi decision making and the national debate on any proposed oil pipeline.

My second talking point is to provide brief background and data on BAOP.

This project has been under official and formal considerations for four decades; it went through two distinct periods of intensive attention while shelved for almost 28 years in between.

The first period, 1983/4, was short but witnessed very intensive efforts at high level of decision making.

A pipeline of one million barrel daily, the US Bechtel Co., was selected to execute the project that could cost estimated to be one billion US Dollar, half of which would be offer by the US EXIM Bank’ financial guarantees.

Iraq requested US government security guarantees for the pipeline against any Israeli attack, but the US government refused to make such undertaking.

The project was shelved, and Iraq pursued other options; the first was to expand the capacity of Kirkuk-Ceyhan (Turkey) pipeline-ITP through a loan from APICORP of OAPEC and, the second was a new pipeline through Saudi Arabia-IPSA, financed fully by Iraq.

BAOP project was completely forgotten due to ITP expansion, IPSA, Kuwait invasion, the sanction and US led invasion of 2003 and its dramatic far reaching consequences.

The second period started in earnest in 2012 and continued to date. Every government and prime minister stated and asserted they have concluded a “Frame Agreement” with Jordan regarding the pipeline, but no substantive verifiable complete documents comprising such frame agreement and feasibility study ever made public!!!!

From whatever available information, I premise my assessment on the following formal data:

The pipeline project is composed of two parts: Part 1, between Basra and Haditha with designed capacity of 2.2mbd, while Part 2, is between Haditha and Aqaba with designed capacity of 1mbd. The two parts have different pipeline sizes, length and there are many pumping stations and tank farms along them and a loading terminal at Aqaba.

The entire project was reportedly estimated cost at $26billion ($4billion for part1 (15.4%) and $22billion for part 2 (84.6%)) as an “investment BOOT/BOT”, or between $8.5 – $10.9billion as “EPCF”.

Obviously, the difference is very huge indeed, but no official clarification was provided, and our repeated questions remained unanswered by any authority within the government!!

I move now to my third item which is about MoC Decision 95 of April 2022.

MoC agrees to adopt a plan to execute the pipeline by the Chinese CITIC’ consortium with Worley Engineering as supervising consultants, according to the proposed EPCF by the Ministry of Oil; the project is to be financed by the Iraq-China strategic cooperation framework and, after 2022 state budget law is promulgated.

The above decision raises more questions than offers answers, clarifications, or assurances.

Discussion within the MoO revealed that no sufficient funding is available under the Iraq-China strategic cooperation framework; no other mean of funding is secured and, 2022 state budget law has not been even proposed so far as the new government has not been formed!! Moreover, nothing at all was released regarding the EPCF proposed by the ministry- utter lack of transparency. Also, it is not clear whether the proposed EPCF is the same or different from that proposed by the MoO in October 2021 and sent then to the Ministry of Planning-MoP for inclusion under the investment provisions of the state budget. And, what makes the matter murkier is a follow-up statement by the MoO asserting MoC decision was only a “roadmap” as the project is still under study and consideration!!

No surprise, therefore, that the pipeline project and MoC decision ignited powerful reactions, mostly by Iraqi parliamentarians and oil professionals.

These reactions include “parliamentary questions” that require formal answer from the MoO, various public statements by parliamentarians and other legal actions. Two legal cases were field before the FHC by the outspoken parliamentarian Dr. Hanan Fatlawi: a “stay/ restraining order” (Amr walaei) and an appeal case, both dated 16 April 2022. Also, a former member of the parliament, Lawyer, Yosuf Al-Kolabi and a group of lawyers and parliamentarians have been considering launching another appeal before FHC.

For the economic evaluation of the project, I used and calculated three criteria as presented briefly hereunder.

- Cost of funding (based on EPCF contract according to MoO October 2021 and MoP December 2021 official data) of capital cost ca. $9 billion, funding cost-accumulated interest ca. 1.9billion. Total cost payable in six equal annual installments.

Funding cost, i.e., accumulated interest, ranges between 21% and 109% of capital provided by the contractor, depending on when these six installments start: after the completion of the pipeline or at the commencement of the construction of the pipeline.

These funding costs are unreasonably high and, if the project is to be financed by the Iraq-China strategic cooperation framework, such cost of funding is totally unacceptable and contravene with the provisions of that framework.

- Cost of “piped-barrel”. This cost was estimated by using full-cycle method; 25 years economic life; $300 million operating cost, $0.25/b transit fee; 4 years construction period with capex distributed evenly; pipeline capacity utilization rate-PCUR ranges from minimum 20% and maximum 80% of designed capacity.

The cost ranges between ca. $10.4/b at 20% PCUR and ca. $2.7/b at 80% PCUR. The implications are if seaborne barrel cost Basra FOB- Aqaba is lower than $10.4/b, it is not rational then for Jordan to import 200kbd through this pipeline AND if it is lower than $2.7/b the pipeline then has ZERO feasibility; it loses any competitiveness!!!

- Limitation and deception of conventional commercial feasibility indicators such as NPV, IRR and Payback-period; this is due to the intrinsic biasness to oil price and its impact. This was proved analytically and empirically in my previous articles on the pipeline and how such arguments prompt corruption, favoring contractor interest and ignore efficiency considerations.

In addition to the above standalone assessment, this project should be subject to thorough comparative assessment; such comparative evaluation covers exports options comprising existing, possible, and potential alternatives.

This takes me to address very briefly these comparative options for export outlets.

- Southern route/Basra export outlets. Now KAOT is expanding to add 600kbd and 300kbd within 6 months and, adding one more SPM would add 900kbd; both options are cheaper, quicker, fully sovereign, have more oil marketing flexibility and generate higher “Netback” for Iraq. Hence, either option is more valuable compared to the BAOP from capacity & operation, economic, financial, national economic security, strategic importance, and geopolitical complications among others.

- The Turkish route provides three options. I- Rehabilitation of pipeline section Kirkuk- Feishkhabor measurement station on Iraq-Turkey borders; II- Use/buy current KRG (KAR/Rosneft) pipeline; III- revive Turkish 2011 proposal for a new Basra-Ceyhan pipeline at, then, $2billion cost for 1.6mbd and 18-24 months construction period. Either option I & II is better than “Part 2” of BAOP, and option III is highly favorable than entire BAOP.

- The Syrian route. This route has many unique advantages: two pipelines- more than 2mbd; two types of crude- regular and heavy oil; two export facilities- Banias and Tertus on the Mediterranean; pipeline to Lebanon; it goes along Railway line Iraq-Syria; mutually supportive to IIS gas pipeline; it benefits from China’s BRI. But this route currently faces formidable geopolitical risks: American policy and military, Qasad, Daesh presence. Also faces opposition from Turkey, SA and Jordan.

- Rehabilitating IPSA; the pipeline costed Capex $2.7billion, Opex $72 annualy, pipeline capacity 1.65mbd (1990). Using same BAOP methodology IPSA had piped-cost of $1.49/b at 20% PCUR and $0.37/b at 80% PCUR (these should be escalated by annual index increase). IPSA rehabilitation remains viable option with competitive/ comparative advantage (from cost, marketing flexibility and geopolitical complexity) over BAOP if it requires partial rehabilitation. But for complete rehabilitation, this route has one disadvantage since most of it is in Saudi Arabia compared with other routes; but this depends on cost of full rehabilitation.

Pro BAOP arguments emphasis the strategic importance of the project; but Aqaba location refutes such claim. Analytically and empirically three strategic national security equations should not be ignored:

- Where there are four states that have direct presence in the area, the geopolitical risks are highly probable and thus the geostrategic importance, for Iraq, diminishes; this applies to Aqaba.

- When a location has Global Strategic Importance, the local geopolitical risks are less probable and less impactful and, thus, geostrategic importance for Iraqi oil exports are secured; this applies to Basra seaboard export outlets via Strait of Hormuz.

- BAOP-P2 route is highly susceptible to local terrorist and sabotage inside Iraq and Jordan, thus very vulnerable from national security and strategic perspectives.

What to do and the way forward

Recent government move contravenes the constitution on many aspects and thus, any legal action against government action should be supported. The government and MoO in particular, should provide and make the FEED and/or a comprehensive feasibility study publicly available.

BAOP’ Frame Agreement is an international bilateral treaty with over 25 years term and, thus it should be debated, approved, and legalized according to the current constitution and valid laws.

Aqaba area is the most vulnerable geopolitically as four states can have very serious impacts: Egypt, Saudi Arabia, Jordan and Israel. Iraqi Ministry of Foreign Affairs should provide its assessment particularly regarding Wadi Araba Agreement between Jordan & Israel and advise on possible implications on this project.

Based on the published data and information, the economic, financial, geopolitical and geostrategic analysis do not support this project and particularly so through thorough comparative assessment. More data and transparency are urgently needed and thus are prerequisite for making final decision on expanding Iraq’s oil export outlets.

The debate on this BAOP with my PowerPoint slides, in Arabic, is available through the following link https://www.youtube.com/watch?v=apg0JY51rQ4

Click here to download the full report in pdf format.

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.

The post Debating the Iraq-Jordan Oil Pipeline first appeared on Iraq Business News.