Genel Energy has issued a trading and operations update in advance of the Company’s full-year 2017 results, which are scheduled for release on 22 March 2018. The information contained herein has not been audited and may be subject to further review.

Murat Özgül, Chief Executive of Genel, said:

“A strong final quarter of 2017 completed a very positive year for Genel. During the quarter, the successful Peshkabir-3 well result tripled production at the field to c.15,000 bopd, a figure that is expected to grow in 2018, while at Taq Taq the TT-29w well was brought on production.

“Payments for oil sales were received from the Kurdistan Regional Government (‘KRG’) in every month of 2017, totalling over $260 million net to Genel and leading to $140 million of free cash flow in the year. The 2017 payments were bolstered by the receipt of override payments in the fourth quarter under the Receivable Settlement Agreement (‘RSA’), and payments have continued in early 2018.

“The recently announced CPRs reaffirmed the potential of the Bina Bawi and Miran fields, with combined 1C gross raw gas resource estimates higher than the gas volumes agreed under the Gas Lifting Agreements. The upstream field development plans are expected to complete shortly, and will help define the roadmap to unlocking the value in these major resources.

“The successful debt refinancing in late 2017, and the expectation of ongoing material free cash flow, provides us with a solid platform and financial flexibility to execute our growth plans during 2018 and beyond.“

2017 OPERATING PERFORMANCE AND 2018 ACTIVITY OUTLOOK

- 2017 net production averaged 35,200 bopd, with Q4 averaging 32,760 bopd. Production and sales by asset during 2017 was as follows:

|

(bopd)

|

Export via pipeline

|

Refinery sales

|

Total sales

|

Total production

|

Genel net production

|

|

Taq Taq

|

11,700

|

6,350

|

18,050

|

18,050

|

7,940

|

|

Tawke PSC

|

108,250

|

10

|

108,260

|

109,050

|

27,260

|

|

Total

|

119,950

|

6,360

|

126,310

|

127,100

|

35,200

|

Note: Difference between production and sales relates to inventory movements

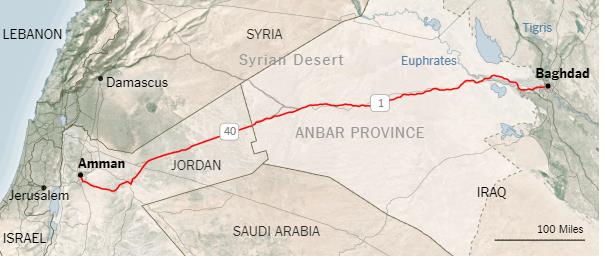

- Tawke PSC (Genel 25% working interest)

- Tawke PSC production averaged 109,050 bopd in 2017, with aggregate production from the Peshkabir-2 and Peshkabir-3 wells contributing 3,590 bopd to this figure. Combined production from the two fields currently averages c.110,000 barrels of oil per day

- Preparations are underway to drill the Peshkabir-4 well. Additional drilling activity is planned on both the Tawke and Peshkabir fields during 2018, with overall activity levels dependent on production performance, drilling results, field studies, and ongoing payments from the KRG

- Taq Taq PSC (Genel 44% working interest and joint operator)

- Taq Taq field production averaged 18,050 bopd in 2017

- Production in Q4 2017 averaged 14,035 bopd (Q3 2017 14,080 bopd). Ahead of the completion of a number of wells in Q4 2017, the overall rate of production decline slowed during the year due to the implementation of a proactive well intervention and production optimisation programme

- In 2018 to date, production from Taq Taq has averaged 14,540 bopd, with the TT-29w, TT-30, and TT-31 wells contributing to the stabilisation in production from the beginning of Q4

- As previously announced in late 2017, the TT-29w well was brought onto production after encountering a deeper free water level and more extensive oil bearing cretaceous reservoirs on the northern flank of the field than previously forecast. The results of the well will be analysed ahead of finalising the 2018 drilling programme, with field activity likely to be weighted towards the second half of the year. The ongoing Taq Taq well intervention programme, focused on the provision of artificial lift and water shut off in existing wells, will continue throughout 2018

- Going forward, the Company will revert to reporting Taq Taq field production on a quarterly basis, as part of its corporate level disclosures

- Bina Bawi and Miran (Genel 100% and operator)

- As announced on 23 January 2018, Genel has agreed a 12 month extension to the conditions precedent schedule contained within the Gas Lifting Agreements for the Bina Bawi and Miran PSCs

- CPRs for the Bina Bawi and Miran West gas fields concluded a c.40% increase in the combined 2C gas resources compared to the pro-forma end-2016 2C resource

- The field development plans, being carried out by Baker Hughes, are on schedule to be completed shortly, and will help define the roadmap to unlocking the value of the assets

- Genel will continue its systematic efforts to maximise the value of Bina Bawi and Miran, which includes optimising the cost and schedule of the proposed upstream developments

- § In 2018 Genel expects to undertake an extended well test of Bina Bawi-4, which will provide valuable data on well deliverability and gas composition

- The Company will continue to build momentum behind the development of Bina Bawi and Miran, and will continue engagement with potential farm-in partners for upstream participation at an optimal time to secure maximum value for Genel shareholders

- African exploration update

- Onshore Somaliland, the acquisition of 2D seismic data on the SL-10B/13 (Genel 75%, operator) and Odewayne (Genel 50%, operator) blocks has now completed – the first time that seismic has been obtained in this highly prospective area for over 25 years. The project acquired c.3,150 km in total, including infill 2D seismic acquisition of targeted high-graded areas. Processing of the data has commenced, and will facilitate seismic interpretation and the associated development of a prospect inventory, in turn guiding the optimal strategy to maximise future value

- As announced in November 2017, Genel’s prior commitment to drill one well on the Sidi Moussa licence, offshore Morocco (Genel 60% working interest), has been replaced by an obligation to carry out a 3D seismic campaign across the Sidi Moussa acreage, significantly reducing anticipated expenditure. Planning is ongoing, with seismic acquisition set to begin in 2018, which is expected to materially de-risk the prospectivity of the Sidi Moussa licence

FINANCIAL PERFORMANCE

- $263 million of cash proceeds were received in 2017 ($207 million in 2016), of which $72 million was received in Q4

- Following the signing of the Receivable Settlement Agreement, effective 1 August 2017:

- $19 million in override payments for the Tawke field were received in Q4

- An additional $7 million of cash flow was generated from the elimination of the capacity building payment on Genel’s profit oil from the Tawke PSC

- $19 million in payments for oil sales during October 2017 received post-period in January 2018

- Free cash flow (pre interest payments) totalled $140 million in 2017

- In December 2017, the Company successfully completed the refinancing of its existing bonds, reducing the outstanding bond debt from $421.8 million to $300 million by way of an early redemption of a notional amount of $121.8 million. The new 5 year bond has a coupon of 10% per annum

- Following the successful refinancing, unrestricted cash balances at 31 December 2017 stood at $162 million ($268 million at 30 September 2017). IFRS net debt at 31 December 2017 stood at $135 million ($138 million at 30 September 2017)

- Capital expenditure for 2017 totalled $95 million (in line with guidance), with the majority of spend on the Taq Taq and Tawke PSCs ($64 million)

2018 GUIDANCE

- Combined net production from the Tawke and Taq Taq PSCs during 2018 is expected to be close to Q4 2017 levels (as disclosed above)

- Capital expenditure net to Genel is forecast to be c.$95-140 million, spanning a range of firm and contingent spend, with activity levels dependent on ongoing drilling results and progress on Miran and Bina Bawi. It is expected that capex will be funded entirely from operational cash flow, and includes:

- Tawke and Taq Taq net to Genel of $60-85 million

- Miran and Bina Bawi capex of $25-40 million

- African exploration cost of $10-15 million

- Opex: c.$30 million

- G&A: c.$15 million cash cost

- Based on a continuation of payments throughout 2018, Genel expects to generate material free cash flow in 2018

(Source: Genel Energy)