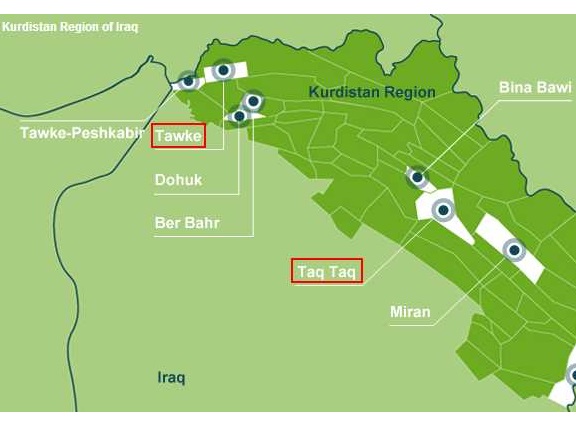

Gulf Keystone Petroleum (GKP), a leading independent operator and producer in the Kurdistan Region of Iraq (“Kurdistan” or “Kurdistan Region”), has announced its results for the half year ended 30 June 2019.

Highlights to 30 June 2019 and post reporting period

Operational

- Average production during August was 39,269 bopd, reflecting the positive results from the workover campaign and facilities debottlenecking at PF-1; gross production this month up to 8 September averaged 39,921 bopd.

- Gross production for the first half of 2019 averaged 29,362 bopd. Average production rates during H1 of 2019 were necessarily affected by wells being off-line for workovers and well maintenance, in addition to the planned shutdown of PF-1 to install facilities as part of the 55,000 bopd expansion project.

- The first well of the drilling campaign, SH-12, successfully reached total depth (“TD”) of 2,112 metres on 23 August. Well results were encouraging with the structure coming in 53 metres higher than prognosis. The well is currently being completed and is expected to be on production later in October.

- Following completion of SH-12, the rig will move to the second well of the campaign, SH-9. This well is designed to assess the gas reinjection potential of the Jurassic formation; part of the longer-term gas management plan for the Shaikan development.

- The workover campaign to install electrical submersible pumps (“ESPs”) in existing wells has been moved into 2020 to coincide with the availability of new permanent facilities being installed as part of the 55,000 bopd expansion programme. These facilities will allow the wells to be cleaned-up more effectively when the ESPs are installed.

- The PF-1 pipeline and export station are nearing completion and will be in full operation following commissioning at which point all Shaikan oil will be exported via pipe.

- A revised Field Development Plan (“FDP”), which addressed additional feedback on gas management, was submitted to the Ministry of Natural Resources (“MNR”) in May 2019. We await formal feedback from the MNR and look forward to a constructive dialogue to finalise the FDP as soon as possible. As we have stated in the past, this delay is not slowing operations and progress on the 55,000 bopd work programme.

- Operations at Shaikan remain safe and secure, with no Lost Time Incidents (“LTI”) in over 400 days.

Financial

- Revenue of $95.6 million (H1 2018: $116.2 million).

- EBITDA of $59.0 million (H1 2018: $61.6 million).

- Profit after tax of $24.2 million (H1 2018: $26.7 million).

- Growth in activity required to bring production to 55,000 bopd led to an increase in cash operating costs and cash operating costs per barrel in line with previous guidance to $18.4 million (H1 2018: $14.1million) and $3.9/bbl (H1 2018: $3.0/bbl) respectively.

- Net capital investment in Shaikan of $32.4 million (H1 2018: $6.9 million). Full year capital investment guidance stands at $88-104 million net ($110-130 million gross).

- Cash balance of $302.7 million at 30 June 2019 and $263.6 million at 9 September 2019.

Corporate

- A $50 million dividend was approved at the June AGM. The first tranche of c.$17 million was paid in July 2019, with the second tranche of c.$33 million to be paid on 4 October 2019.

- A $25 million share buyback programme was announced in July. The Company is pleased to confirm that the first tranche of $15 million was completed on 30 August.

- Today, the Company is resuming its buyback programme for the remaining $10 million.

- Following completion of the above, the Company will have returned $75 million to its shareholders in 2019.

Outlook

- Active work programme to continue with the ongoing Jurassic drilling campaign, ESP workovers and completion of the debottlenecking plan with the Company remaining on track to deliver 55,000 bopd in Q2 2020.

- Total capital expenditure of $200-230 million gross for the 55,000 bopd expansion programme remains in line with earlier guidance.

- Gross production guidance for 2019 is now expected to be between 30,000-33,000 bopd, compared to previous guidance of 32,000-38,000 bopd. This new guidance considers the delayed start to the drilling campaign, the postponement of the ESP workover campaign and the planned shutdown of PF-2 in October.

Jón Ferrier, Gulf Keystone’s Chief Executive Officer, said:

“The first half of 2019 saw high levels of operational activity as we continue to develop Shaikan targeting a significant, phased, production uplift. Despite some operational delays, we have made considerable headway towards our 55,000 bopd production target.

“Activity has further increased during H2 2019 as we remain on track to achieve this milestone in the first half of 2020. As a consequence of the work to increase production in the longer term, the near-term production guidance for the full year has been reduced. However, the Shaikan reservoir, the cornerstone of our equity story, continues to behave strongly.

“The Company has a robust balance sheet which supports operational funding requirements and expansion plans in addition to returning funds to shareholders. The Company is therefore well positioned to deliver on its growth objectives for the benefit of all stakeholders.”

(Source: Gulf Keystone Petroleum)