By John Lee.

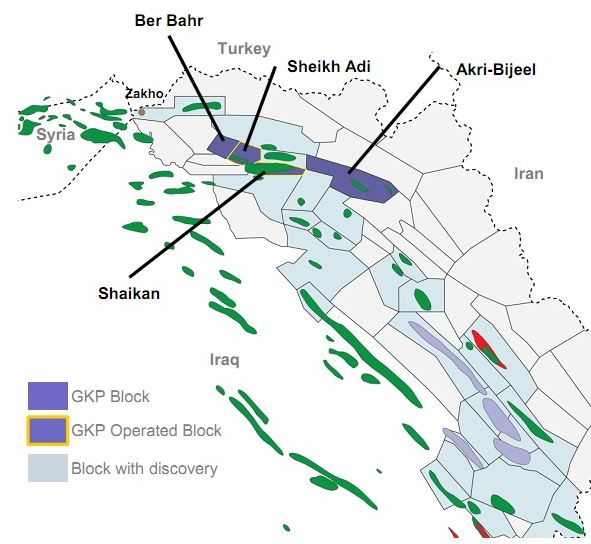

Genel Energy has announced the completion of competent person’s reports (‘CPRs’) relating to the oil reserves and resources at Taq Taq, Bina Bawi, and Miran.

McDaniel and Associates have updated the CPR relating to the Taq Taq field (Genel 44% working interest, joint operator).

RPS Energy Consultants Ltd. (‘RPS’), as part of its work on the updated CPRs for the Bina Bawi and Miran West fields (Genel 100% and operator), has finalised its evaluation of the oil resources at both fields.

Murat Özgül (pictured), Chief Executive of Genel, said:

“The 40% replacement of 1P reserves at Taq Taq follows the success of well TT-29w, and reflects the stability in cash-generative production that we have seen from the field in the second half of 2017. The significant increase in high-value Bina Bawi 2C oil resources offers a tangible opportunity for near-term value creation.”

Taq Taq oil reserves

Taq Taq gross 2P reserves as of 31 December 2017 are estimated by McDaniel at 54.7 MMbbls, compared to 59.1 MMbbls as of 28 February 2017, with the difference being production in the intervening period, partly offset by a small upward technical revision.

The CPR results in a 12% reserves replacement for 2P and 40% reserves replacement at the higher confidence 1P level as a result of stabilising production and the integration of well TT-29w. A reconciliation from the reserves reported in the CPR released in February 2017 to the updated estimates in the CPR published today, is shown in the following table:

|

Gross oil reserves (MMbbls – McDaniel)

|

1P

|

2P

|

3P

|

|

28 February 2017

|

25.8

|

59.1

|

95.0

|

|

Production

|

(5.0)

|

(5.0)

|

(5.0)

|

|

Technical revisions

|

2.0

|

0.6

|

0.1

|

|

31 December 2017

|

22.8

|

54.7

|

90.1

|

Bina Bawi and Miran oil resources

Bina Bawi gross 2C light (c.45◦ API) oil resources as of 31 December 2017 are estimated by RPS at 37.1 MMbbls, compared to 13 MMbbls as of July 2013. The increase reflects higher recovery factors than initially estimated due to integrating learnings from analogue carbonate fields of similar oil quality. As the high-quality Bina Bawi oil is in close proximity to export infrastructure, the field represents a potentially attractive near-term development candidate for the Company.

Miran West gross 2C heavy (c.15◦ API) oil resources as of 31 December 2017 are estimated by RPS at 23.7 MMbbls, compared to 52 MMbbls as of April 2013. Volumes have reduced as RPS has adjusted its view on the oil water contact uncertainty range and also adjusted its view on reservoir properties, including data from MW-5 drilled in July 2013.

Because of field experience at Taq Taq, Genel management has taken the view that it is unlikely that any matrix will contribute to primary depletion at Miran and, as such, has taken a more conservative view and will only record 18.5 MMbbls of viable 2C contingent resources at the field.

|

|

Gross 2C Contingent Resources oil (MMbbls – RPS)

|

|

|

2013

|

31 December 2017

|

|

Bina Bawi

|

12.9

|

37.1

|

|

Miran West

|

52.0

|

23.7

|

Appendix

Summary of Contingent Resources – Development unclarified (Gross 100% working interest basis) attributable to the Bina Bawi and Miran West fields as of 31 December 2017.

|

Gross (100% WI) Contingent Resources

|

|

Gross (100% WI) Contingent Resources

|

|

Bina Bawi

|

Oil (MMbbls – RPS)

|

|

Miran West

|

Oil (MMbbls – RPS)

|

|

1C

|

15.2

|

|

1C

|

6.1

|

|

2C

|

37.1

|

|

2C

|

23.7

|

|

3C

|

78.4

|

3C

|

67.6

|

(Source: Genel Energy)