By Salam Zidane for Al Monitor. Any views expressed here are those of the author, and do not necessarily reflect the views of Iraq Business News.

Iraq has much to gain from gas-supply pact with Kuwait

Kuwait will begin importing natural gas from neighboring Iraq this year, a development welcomed in Baghdad as it could improve Iraq’s relations with the Gulf countries — relations that ruptured when Iraq invaded Kuwait in 1990.

Most of Iraq’s gas is associated petroleum gas, also known as flare gas. Associated petroleum gas is a byproduct of oil production, as opposed to natural gas that comes directly from gas reservoirs in the ground.

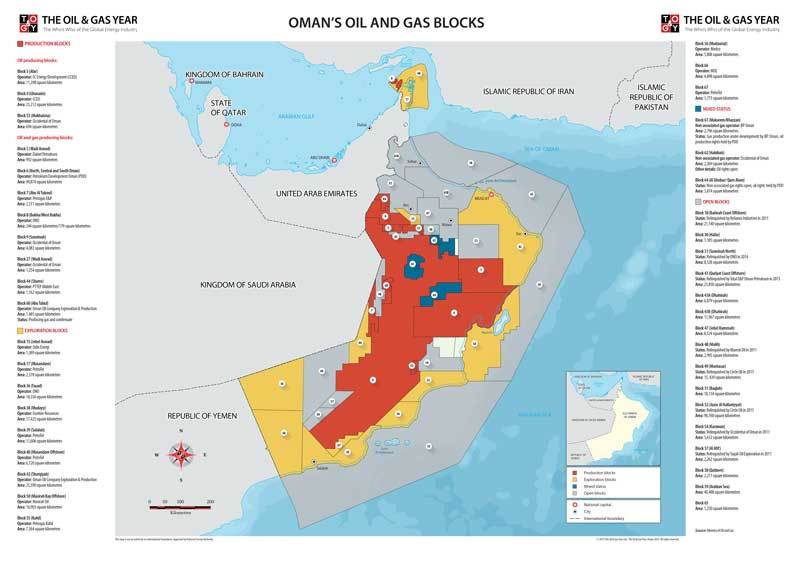

The Iraqi Ministry of Oil has decided to export associated petroleum gas from international oil companies operating in southern Iraq to Kuwait via a gas pipeline near Basra. Kuwait would then turn it into dry gas, condensates and liquid gas, among other types. According to the Ministry of Oil, Iraq flares 1.5 billion cubic feet of gas daily.

Ministry spokesman Assem Jihad told Al-Monitor, “Iraq will export to Kuwait the associated gas, part of which is flared on a daily basis. Processing natural gas is a complex and expensive industrial process that requires building plants through local and foreign companies.”

Jihad said, “Iraq is set to supply Kuwait with 50 million cubic feet of gas daily, which will gradually increase to 200 million cubic feet [depending on] international prices. The gas will be exported through the three-decade-old pipeline linking the two countries. The pipeline, however, needs maintenance. Iraq will take care of maintenance over the 30 kilometers [19 miles] of pipeline stretching within its territory, while Kuwait will handle its part of the pipeline.”

Iraq has lost billions of dollars annually as a result of wasteful gas flaring and its importation of diesel fuel for electricity. That’s not to mention the low levels of energy efficiency because many Iraqi power stations run on dry gas, which is not produced locally.

What has compounded the problem is the reluctance of some oil companies to exploit associated gas despite the increase in Iraq’s crude oil production from an average of about 1 million barrels per day in 2003 to roughly 4.3 million per day in December, which increased gas flaring from 700 million cubic feet to 1.5 billion cubic feet daily.

Kuwait will lay the pipeline to the neighboring Rumaila oil field, the largest in the world, under the supervision of the BP oil company. The agreement is likely to be implemented soon, since Kuwait has a demand for natural gas that exceeds its supply by an estimated 500 million cubic feet daily. Kuwait has been unable to curb this deficit in part because of tension among Gulf countries that has prevented Qatari gas from flowing into Kuwait via Saudi Arabia; Reuters reports that much of the shortfall is being covered by imports of liquefied natural gas.

The Iraq-Kuwait associated petroleum gas deal should help Iraq pay off the remaining reparations for the invasion of Kuwait, amounting to $4.5 billion.

Iraq’s parliamentary Oil and Gas Committee criticized the government’s energy policy for relying on the development of oil production and neglecting natural gas processing, which could put an end to the country’s electricity crisis and launch petrochemical industries. Committee member Zaher al-Abadi told Al-Monitor, “Iraq is losing billions of dollars in flaring gas, while the Ministry of Oil is standing idly by.”

Oil expert Hamza al-Jawahiri, who is knowledgeable about the agreements between international oil companies and the Ministry of Oil, and between the ministry and various countries, said Kuwait will process the natural gas in Iraq and then transport it to its cities.

“As per the agreement, Kuwait will bear the expenses of building plants, processing and piping the gas,” he said. The gas will be processed in Iraq by separating impurities and non-methane hydrocarbons and fluids to produce dry natural gas.

Jawahiri added that Kuwait signed an agreement months ago with Basrah Gas Company, which is part of the latest gas export agreement, noting that other sources of gas will include rich oil and gas fields in southern Iraq. Basrah Gas is a consortium of three businesses including the majority shareholder South Gas Co., Shell and Mitsubishi. The consortium exploits gas from three oil fields.

Shaalan al-Daraji, Basrah Gas chief information officer, told Al-Monitor the company’s plan, which runs until 2021, aims to end the flaring of gas in the Zubair, Qurna 1 and Rumaila oil fields. “The company currently produces 700 million cubic feet of gas daily and has a strategic plan to stop gas flaring in oil fields,” Daraji said.

Iraqi Prime Minister Haider al-Abadi expressed great support for the Kuwait agreement, which could end Iraq’s long-standing estrangement with the Gulf countries, as Kuwait has asked the United Nations Security Council to lift sanctions on Iraq.