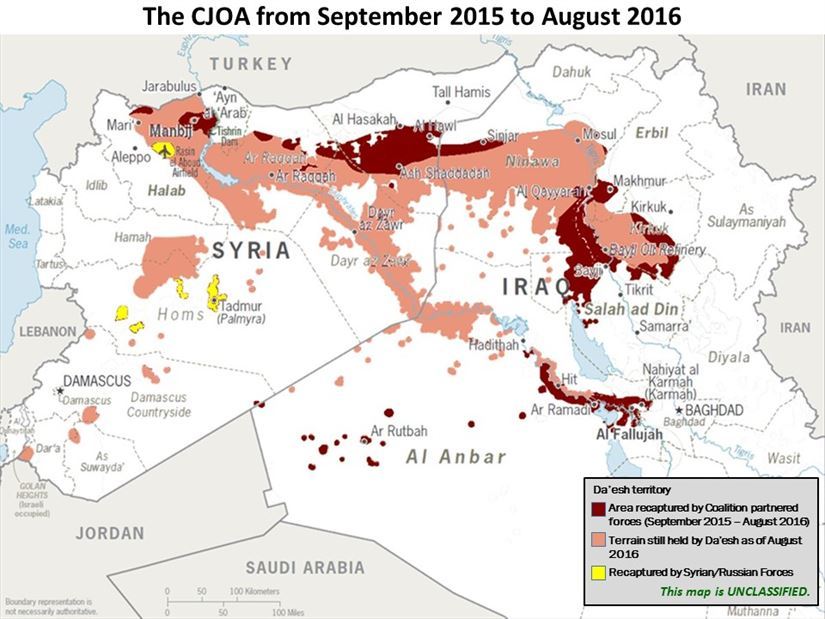

Shares in Genel Energy were trading up 6 percent on Monday afternoon after the company announced that it has reached agreement to acquire stakes in the Chevron-operated Sarta and Qara Dagh blocks (pictured), in the Kurdistan Region of Iraq.

Genel will acquire 30% equity in the Sarta licence by paying a 50% share of ongoing field development costs until a specific production target is reached, together with a success fee payable on achievement of a production milestone. Chevron will retain a 50% interest in the Sarta licence and the Kurdistan Regional Government will hold the remaining 20%. Genel’s estimate of its total spend up to end-2020 is c.$60 million.

Drilling began on the first appraisal well, Sarta-3, in Q4 2017. The well was successfully completed and tested during the second quarter of 2018. Both that and the Sarta-2 well individually tested at rates of c.7,500 bopd. The first phase of development is expected to see these wells placed on production.

Genel will acquire 40% equity of the Qara Dagh appraisal licence and become the operator through a carry arrangement. Chevron will retain 40% of the equity, with the KRG holding the remaining 20%. The Qara Dagh-2 well is set to be drilled in 2020. The Qara Dagh-1 well, completed in 2011, tested oil in two zones from the Shiranish formation.

Closing is subject to approval from the Kurdistan Regional Government.

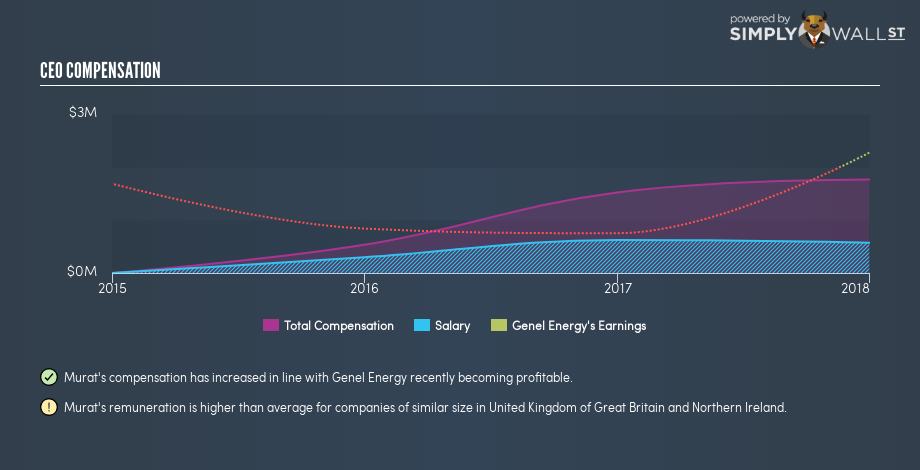

Murat Özgül, Chief Executive of Genel, said:

“We are delighted to have been chosen as a partner to Chevron. The agreement provides access to a phased development opportunity with significant growth potential at Sarta, and an exciting appraisal opportunity at Qara Dagh. The additions to our portfolio are an important step in our diversification strategy, offering a further opportunity for near-term production and cash-generation.”

(Sources: Genel Energy, Yahoo!)