By John Lee.

Oryx Petroleum Corporation has announced that it has changed its name to Forza Petroleum Limited.

2021 Budgeted Capital Expenditures

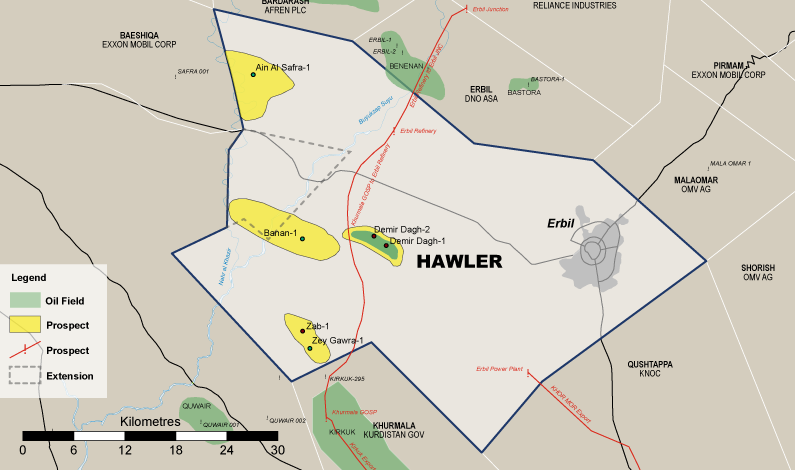

Budgeted capital expenditures for 2021 are $51 million and dedicated exclusively to the Hawler license area.

The planned work program involves drilling five new wells into proven, producing reservoirs and reservoirs still being appraised in the Demir Dagh, Zey Gawra and Banan fields, completing a previously drilled well in the Ain al Safra field for further evaluation, and installing a gathering system to eliminate trucking in the western part of the Hawler license area to reduce environmental impact and operating expense.

Completion of the full budgeted program is dependent on available funding from one or a combination of increased revenue from oil sales resulting from higher than forecast Brent crude oil prices or production, settlement of past due receivables by the Ministry of Natural Resources of the Kurdistan Region of Iraq in respect of oil sales made between November 2019 and February 2020, and additional funding from third parties.

The Corporation is in discussions with its controlling shareholder regarding financing arrangements to fund budgeted capital expenditure to the extent internal capital is not available.

Operations Update

- Average gross (100%) oil production of 11,100 bbl/d (participating interest 7,200 bbl/d) for November 2020

- During November, leased artificial lift equipment used to produce the Banan-4 and Banan-3 wells was demobilized and replaced by a purchased pump in the Banan-4 well, reducing future operating expenditure related to producing the Banan field

- The previously announced new well targeting the Tertiary reservoir in the Zey Gawra field is not expected to spud before January 2021 as the drilling rig intended for the project continues to be in use by another operator in the region and has not yet been released

CEO’s Comment

Commenting today, Forza Petroleum’s Chief Executive Officer, Vance Querio (pictured), stated:

“We are very encouraged by the rebounding crude oil market and plan to maintain an active program of drilling during 2021 to continue the progressive development of the Hawler license area in the Kurdistan Region of Iraq. We intend to increase our offtake rates from some of our proven, producing reservoirs and to continue evaluating the potential of other accumulations in the area that have not previously been produced.

“During a difficult year related to the global pandemic and other headwinds across the oil and gas industry, we have remained committed to maintaining safe operations and decreasing operating costs where possible. The installation of a gathering system to serve the western flank of the Hawler license area will support both of these objectives by dramatically reducing the potential of environmental impact and the relatively high cost of tanker transport operations in the area.

“We look forward to an improving operating environment in 2021 and to continuing our successful efforts to develop the resources of the Hawler area for the benefit of Forza Petroleum, the Kurdistan Regional Government, the employees of OP Hawler Kurdistan Limited and the citizens of the communities in which we operate.”

(Source: Oryx)

The post Oryx Petroleum Changes Name, Plans m Capex first appeared on Iraq Business News.