By Ahmed Mousa Jiyad.

Any opinions expressed are those of the authors, and do not necessarily reflect the views of Iraq Business News.

The New Petroleum Bid Round Faces Many Serious Problems

Since the last Ministerial reshuffle of August 2016, the Ministry of Oil has been persistently trying to offer most possible oilfields and exploration blocks to IOCs under new contracts that differ from those adopted by the Ministry in previous rounds. The latest attempt in this regard is the announcement by the Ministry that it has scheduled the date of a new round and has presented the timeliness of the necessary activities.

Briefly, as stated in this intervention, the timing of this round is rather unfortunate; many of the qualified IOCs by the Ministry are blacklisted; absence of transparency on the proposed contracts; method for evaluation and selection of different offers, by IOCs, have not been announced and finally, no feasibility study of any fields or block was available, let alone done. But, the fact that these fields and blocks are stranded on the borders they have special status and thus should deserve attention and prioritization.

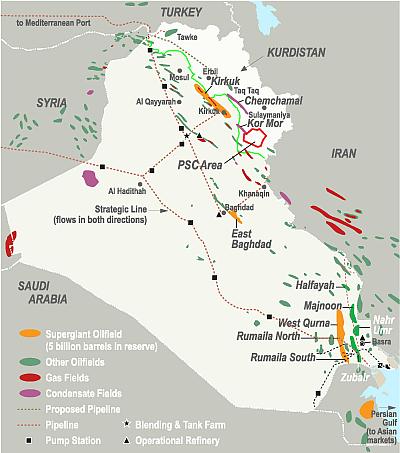

At the outset a brief note is probably relevant. Since the national election date was initially proposed there has been a pattern of “pre-election rush” at the Ministry of Oil for announcing many recent events, creating what might be called “election-linked achievement bubbles”: Majnoon oilfield transition deadline was shortened from end June to end March 2018; concluding contract for East Baghdad oilfield; signing agreement on Nehr Bin Omar on associated gas utilization; singing agreement with BP on Kirkuk oilfield; setting earlier date for border fields and blocks bid round; and sudden announcement, on 28 January, for offering Faw refinery & petrochemical of 300kbd (without any FEED or any further basic information). What next!

In previous occasions I addressed, as mentioned below, all attempts by the Ministry in this regard, especially since its first announcement, in July 2017, on this new round. Therefore, the focus will now be on this new round and by using official statements, especially those issued by the Ministry of Oil.

First: Licensing Date and its Timetable

Petroleum Contracts and Licensing Directorate-PCLD of the Ministry announced recently that it will hold on May 7, 2018 this bid round according to a tentative schedule of activities.

The date is actually over two months earlier than envisaged based on previous announcement by the same entity; resulting into adoption of a brief, unrealistic and impractical timetable that could have negative consequences on the process itself, thus questioning the possibility of holding the round on the designated date.

It is worth recalling that the Minister and PCLD’s DG stated, in their press conference held at the Ministry on November 27, 2017, that “the final tender document will be announced on May 31, 2018, and then the bids from companies wishing to compete in the round will be received.” The Ministry and PCLD announcement did not specify, then, the date of the round. Given the need to provide sufficient time for IOCs to study and evaluate the final tender protocol, the provisions of the contracts and determine their position to submit their bids individually or within consortium, the date of the round could (realistically and technically) be in mid-July 2018 the earliest.

It should be noted that the period between the “announcement of the final tender document of the contracts” and the day of “licensing round” were, for example, more than five weeks in each of the first and fourth bid rounds.

Apparently, the timeliness of activities necessary for holding this round was set at four months between the date of “Data Package” sale on 7 January and 7 May 2018; a very short period indeed compared with previous rounds considering the apparent difficulty and complexity of the new bid round.

Every bid round of the previous four was structured around one type contract only for all offered fields or exploration blocks in the related round; in this round there will, at least, three different types of contracts to be proposed by the Ministry and an unspecified number of “commercial models / contracts” expected from the IOCs!!

Each contract in the previous four licensing rounds involves only one field (with the exception of the three Missan oilfields) or one exploration block; in this bid round, most of what is announced includes more than one field or block, and in fact even more than what was announced in July 2017. The extreme example is Naft-Khana, comprising nine fields and exploration blocks; and this, as discussed later, necessitates the formulation of composite-complex contract that could actually comprises three or even four different contracts- perhaps a unique or the only one of its kind!

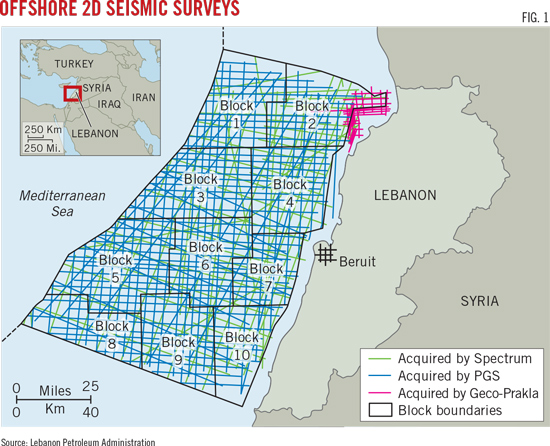

All the fields that were included in the first three bid rounds and all exploration blocks of fourth bid round are located inside Iraq; while all the fields and blocks offered in the new round are located along land borders with Iran and Kuwait, except one offshore block on Iraqi territorial waters in north Arabian Gulf. As highlighted below, border fields should receive special consideration seriously and fully.

Finally, international petroleum business environment and IOCs enthusiasm (on Iraq) in 2018 is very different from those prevailed during June 2009- May 2012 when the previous four bid rounds were held. That could prompt IOCs to propose more complicated contracts with less attractive terms for Iraq, thus make it imperative for the Ministry officials to be extremely careful and devote enough time to assess what IOCs propose. Probably, the current failure (but not yet ended) after many months of direct behind closed door negotiation, with ExxonMobil/CNPC regarding the package for developing Ratawi and Nahr Bin Omar oilfields and the linkage to CSSP and SIIP, provides indications on what IOCs are asking to have.

By comparative analysis, it becomes very clear that the proposed timetable is unrealistic, not practical and very well could derail the bidding event itself. It is therefore legitimate to pose a few questions about the rationale of such hastiness: Does the Ministry have the human, legal and institutional skills and capacity to carry out all the required activities within the times specified in the schedule? Has the three models of contracts been studied thoroughly enough to ensure and protect the rights and interests of Iraq, especially since all the fields and blocks are close to or cross the border with Iran and Kuwait? But the most compelling question is why and under whose directives the date was set at 7 May 2018.

The Ministry did not provide any clarification on why it went for an early bidding date and for such a tight compact timetable of essential activities.

A through daily follow-up of the Ministry news found no compelling reasons or urgency to hold the bidding at the specified date. But, what is surprising that the date was fixed, earlier than previously announced, soon after the date for the national election, on 12 May, was decided by the Cabinet (and now confirmed by the Federal Court and the Parliament).

Was the new timing for the bid round just unfortunate coincidence (though this reflects either political naivety or wrong decision-making or a combination of both) or a deliberate decision with motivations? If it was a bad unfortunate coincidence, why did the Ministry not change it? But, if it was intentional, what is the intention: score an achievement or impose a fait accompli or jump ahead- looking to the next cabinet reshuffle or to fulfill a pledge or “let it go” since everyone will be preoccupied with the election or.. or any other imaginable or possible explanations

Whether the timing is coincidental or intentional, holding the licensing round a few days before the national parliamentary (and possibly provincial) elections could contribute to maximize risk and uncertainty for and by all serious international companies, which could prompt them not to buy the Data Package and pay non-refundable $100,000 fee. In the case of limited purchase of the Package, that means the Ministry has actually contributed to its own failure and that may compel it to postpone the event to another date. But frequent postponement contributes to credibility erosion; as manifested by the refineries that have been re-announced several times over the past 15 months without any material luck!

Increasing risk and uncertainties that are associated with the date of the bid round could, in IOCs due diligence, come from the following possibilities:

- The period between bidding results (in case of winning) and the agreement on the final version of each contract, obtaining the final approvals by the Council of Ministers, the final signing of the contract and the entry into force of the contract usually takes more than two months, i.e., after the election;

- Elections may lead to a government change, which may have different agenda and position contrary to the outcome of the bidding and, possibly, dot not approve the contract;

- Similarly, the election may lead to change the Minister of Oil himself. The new Minister or his political bloc may have a position contrary to the position of the current Minister; that could prevent the finalization of the contract and therefore not to be referred to the Council of Ministers for approval;

- The formation of the new government takes usually a good deal of time depending on the actual election results and the need to formalize the political alliances, and this could take many months. This practically means that the current government becomes a caretaker government that, constitutionally, cannot take decisions binding the new government to such international contracts. Meaning, the current government cannot and should not ratify any contract resulting from the licensing round, especially with the existence of a new parliament; keeping in mind that all these contracts are for boarder fields- a highly sensitive and complex matter.

It is rather regrettable that the concerned parties, especially the Energy Committee of the Council of Ministers and the Oil & Energy and Legal Committees of the Parliament, have not taken the right action to prevent the Ministry from convening the bid round on the stated date or to postpone it to after the formation of the new government.

Second: Blacklisted Qualified Companies

Since the first bid round, PCLD of the Ministry has adopted a detailed method whereby companies are evaluated for the purpose of ascertaining their eligibility to participate in the field development and exploration projects as operator and non-operator. The evaluation methodology includes several details covering at least the last three years of four sets of indicators or standards:

- Financial and Economic Standard

- Legal Standard

- Technical and Training Standard and

- Health, Safety and Environment Standard.

The most questionable about this bid round is the list of qualified companies by the Ministry, which comprises many blacklisted IOCs contrary to its own declared and maintained policy that has been adhered to for many years in implementation of and in conformity with the official position of the Iraqi government, which considers all contracts signed by the KRG are illegal and contravening the Constitution. This means legally, logically and practically that any party that signs a contract that the sovereign authority considers to be contrary to the Constitution shall have knowingly committed a violation of the Constitution. As a result, the application of the “legal standard” directly leads to automatic disqualification of any company that has already committed a flagrant infringement of the Constitution.

PCLD had announced the companies eligible to participate in this round and in the light of available information, blacklisted qualified companies fall in two groups:

The first group comprises companies that signed contract(s) with KRG after had signed a contract through the bid rounds organized by the Federal Ministry of Oil. These companies are ExxonMobil (USA), Total (France) and Gazprom (Russia).

Although these three companies are still working in the oilfields contracted within the first and second licensing rounds, the application of the legal standard should prevent them from participating in this round.

In fact, these companies were excluded from contributing to the development of the field part within the “Nassiriyah Integrated Project-NIP” and were allowed to contribute to the refinery part only (though NIP project was abandoned by the Ministry!)

The second group companies that have signed contract with KRG but have not a contract within the licensing rounds organized by the Federal Ministry. These companies are: Dana Gas and Crescent Petroleum-CP (both in the UAE) and Sinopec (China).

It is worth mentioning that the Ministry of Oil terminated on 8 May 2009 the memorandum of understanding with Crescent Petroleum signed on 28 September 2005 after the company signed a contract with KRG. Then the Ministry qualified Crescent Petroleum (!!) for the ill-fated offering of 12 new oilfields announced in October 2016, only two months after the current Minister took the helm of the Ministry, (http://www.iraq-businessnews.com/2016/10/27/jiyad-min-of-oil-should-withdraw-plan-to-offer-12-new-oilfields/ )

Moreover, the Ministry had introduced the following provision in the contract for bid round four giving related Iraqi contracted entities (NOCs) the power to terminate the contract if, “Contractor, a Company or their Affiliates: either violating in any material respect a Law, including, without limitation, any directive or instruction of the Government (including the Ministry of Oil); or entering into any contractor agreement relating to the exploration, appraisal, development or production of Hydrocarbons in the Republic of Iraq, that has not been approved by, or consented to by, the Government;”

I have already made it clear that granting contracts for field development or exploration blocks to companies that are still operating contrary to the Constitution is only equivalent to rewarding those companies for their violations of the Constitution and the declared policy of the federal government; that should not be allowed (http://www.iraq-businessnews.com/2017/12/26/majnoon-development-plan-important-move-in-the-right-direction/).

The application of the legal standard should prevent these companies from participating in this round. Therefore, I call upon the Parliament/House of Representatives to take a decision, similar to that of January 8 regarding KAR Company, to compel the Ministry disqualify the above six blacklisted companies from participating in the new round.

Finally, it is worth mentioning that PCLD list comprises Shell and Petronas; both formally exited, recently, Majnoon giant oilfield. Probably, we have to wait until 5 February to know whether Shell and or Petronas buys the Data Package or not, and if either does then we should explore to know and explain why. And for Shell does this return has anything to do with its interest in Azadegan oilfield on the Iranian side of the borders?

Third: Transparency Considerations and the Proposed Contracts

According to the proposed timetable for the licensing round, PCLD will, on February 5, “convene a Roadshow to discuss the general principles of the contract and the commercial models submitted by companies”. However, PCLD did not specify the location of the workshop; the number of submitted models; when they were submitted; by which company and whether those models related to the fields or blocks or the offshore one or all of them.

In addition, there is a complete blackout on the type and components of the contract(s) that will be presented by the Ministry in the planned roadshow. Moreover, what complicates the matter even more are the ambiguity and strange statements. For example, the Minister said, “The contracts that are hoped to be concluded with the international companies in this round are an important step towards adopting a new commercial model and financial terms different from the previous contracts. The commercial models, by the companies wishing to invest, will be studied and analyzed then negotiated and select the contract which achieves our objectives”

How can the Ministry achieve its objectives without specifying and disclosing what are those objectives? How can it achieve these goals by relying on models proposed by the IOCs themselves? And when will the “study and analysis of business models provided by companies wishing to invest,” be done knowing that there are 9 groups of fields and blocks; 3 or 4 types of contracts and 21 companies eligible to participate in the round?

As mentioned above, by covering areas for three different types of already producing (brown) fields with discovered by not developed (green) fields and exploration blocks in a single contract necessitates the formulation of a complex difficult contract, largely due to the significant differences between the financial terms, contractual provisions and technical and geological requirements of these three covered areas.

Finally, and this is very important, the contracts of this bid round should reflect the special status and the prioritization of developing fields straddled along borders with Kuwait and Iran, especially with regard to the possibility of joint development through the formula known as Unitization of the concerned field. This is in addition to the need to include in the contracts many of the conditions, provisions and practices recognized by international contracts of border fields.

In the case of complex contracts covering three types of fields and blocks concurrently, they become even more complex and difficult when adopting Unitization formula (by virtue of being structurally tripartite), which requires high skill capacity, professional negotiation, relevant experience and an integrated team covering all technical, legal, contractual, economic and geopolitical operational aspects (http://www.iraq-businessnews.com/2017/07/21/important-oil-projects-dubious-non-transparent-contracts/).

Can the Ministry study and analyze the commercial models that will be submitted by the companies during the period specified in the timetable, which is only ten days? Very doubtful! And the strangest of all, is what the Minister says, “the Ministry was keen to optimize its preparation for this bid round”!!!

In the light of the foregoing, the extent of absent transparency is evident, especially with regard to the types of contracts and their basic financial conditions; but this is, regrettably, not unusual practice at the Ministry. For example, the Ministry did not announce any information on its recent signed deal with Jinhua, a Chinese company, to develop East Baghdad Oilfield or the contract with Orion- a US company.

The Minister of Oil said that “the contract to develop East Baghdad Oilfield is different from previous service contracts, where some important changes were made to the contract formula that serves the public interest.” So far, neither the Minister nor the Ministry clarified what these “important changes” are and what the material evidence and the economic feasibility which prove in figures that these amendments “serve the public interest.” The same applies to the agreement signed by the Ministry on January 8, 2018 with the US company Orion to utilize associated gas from Nahr Bin Omar oilfield in Basrah province, as well as the contract / agreement signed with the GE-US company in July 2017 related to associated gas from Nassiriyah and Gharraf oilfields in Dhi Qar province, among others. As usual, the Ministry did not provide any information about these agreements nor about the contracts or agreements that were signed.

Moreover and worst still, all the above mentioned contracts and agreements were negotiated and concluded without following the usual official contracting procedure that requires public tendering, open bidding and transparent selection.

Strangely enough, this is happening even after the Extractive Industries Transparency Initiative suspended, recently, Iraq’s membership for non-compliance. EITI presented detailed two reports (in both Arabic and English) highlighting what provisions did Iraq not comply with and what it should do to restore its membership in the organization (http://www.iraq-businessnews.com/2017/11/06/eiti-suspends-iraq-membership-a-serious-setback/ )

This clearly indicates the lack of proper understanding of the Ministry leadership of what transparency in the oil sector entails and what requirements that should be clearly disclosed in accordance with EITI Standard.

In conclusion, due to the importance and urgency of the matters I suggested:

- The Ministry of Oil announces immediately the postponement of the bid round to a later date to be announced after the formation of the new government;

- If the Ministry fails to do so, the Council of Ministers or the Parliament should oblige the Ministry, by issuing binding instructions, to postpone the round;

- The Council of Ministers and the Parliament should oblige the Ministry of Oil to implement the policy of the federal government by preventing blacklisted companies from participating in this round;

- The Ministry of Oil must adopt a realistic and practical timetable that allows its concerned entities, especially PCLD, to study thoroughly and develop the “complex contract” for the border fields;

- The Ministry should adopt and exercise full transparency by early disclosure of the basic terms of the contracts proposed by it and by the oil companies and provide (in numbers rather than rhetorical statements) how could these conditions serve the national interest of Iraq.

Earlier Arabic text was posted on http://www.akhbaar.org/home/2018/1/239828.htm

Please click here to download the full article in pdf format.

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.