By Ahmed Mousa Jiyad.

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News.

IOC’s Strategic Positioning in Iraq Upstream Petroleum

Much talk have been circulating recently on “Big Oil” abandoning Iraq upstream petroleum projects after they rushed into the country many years ago. How much truth is in this; who is leaving, remaining and planning a comeback; why and what material evidences are available to provide verifiable realistic explanation are some of the topics this brief intervention attempts to address.

IOCs positioning in Iraq upstream petroleum have seen a dramatic shift since a Grand Opining Big Push Policy- GOBPP was pursued in 2004; offering IOCs opportunities to achieving unprecedented expansion in the petroleum production capacity during short period.

Their involvement and strategic positioning went through three phases: the first, 2004 to end 2008, comprises many memoranda of understanding/cooperation (MoU/Cs ) in search for foothold and as springboard for further opportunities; transparent competitive bidding phase, June 2009 to May 2012, includes four bid rounds and, third phase covers contracts implementation that began from January 2010 up to date.

Ministry of Oil- MoO concluded some 40 MoU/Cs with IOCs from 23 countries, with overwhelming dominance of the US (9); Japan and Norway (4 each); China, UAE, UK and Canada (2 each) and one company from 16 countries.

For IOCs, MoU/Cs represent invaluable direct contact with Iraqi staff and professionals at all layers of responsibility and access to most archives and database relating to upstream petroleum; that helped IOCs exploring where and what they could do to chart their way towards business in Iraq’s upstream petroleum and beyond, i.e., to plan their strategic positioning in the sector. Some IOCs had their MoU/C terminated and were blacklisted from further involvement in upstream petroleum projects, due to their agreements with KRG in violation of the government declared policy.

MoU/Cs contributed in formulating and development of a model contract, and by the time they were terminated MoO succeeded, through direct government-to-government talks (with China), in converting Alahdab oilfield from production sharing to service contract. That conversion presents the model for what MoO offers: a long term service contract not a production sharing contract; an outcome many IOCs had not hoped for and probably impacted their decision for further undertaking.

The first bid round, for brown oilfields, was held end June 2009, followed by three bid rounds for green fields, gas fields and exploration blocks respectively; the last was convened end May 2012.

120 IOCs participated in the qualification process for the bid rounds, 55 from 27 countries were qualified: Japan (9); USA (7); Russia (5); China and UK (4 each); Australia, India and Italy (2 each), and 19 other countries with one company each; a different profile from phase one with obvious strategic positioning implications.

The outcome of the four bid rounds and Alahdab are: 14 oilfields contracted to 15 IOCs from 12 countries; a consolidation of strategic positioning. Total contracted plateau production was 12.3mbd and their total proven reserves ca. 67 billion barrels (58% of the country’s proven reserves at that time). Three gas fields were contracted to 3 IOCs from 3 countries with total plateau production of 820mcfd and proven reserves of 11.2tcf. Finally, four exploration blocks were contracts with 7 IOCs from 5 countries resulting in discovery of Fayha and Eridu oilfields.

The contracted plateau production of 12.3mbd was IOCs making that proven to be unrealistic and unattainable, thus, consequently revised downward repeatedly!!

During the second phase many meaningful signs for significant shift in IOCs strategic positioning began to emerge, the most apparent consolidation was Russia.

The third phase, i.e., contracts implementation period, witnessed the most dramatic effective and lasting shifts in IOCs strategic positioning.

A complexity of combined reasons had contributed to such an outcome; some are related to IOCs themselves, others related to the Iraqi side (entities, policies and circumstances), while the rest are related to a variety of international factors and geopolitical considerations. Space limitation prevents from indulging in the details of relevant data, facts and documents, but it is useful to mention the most impacting among them: Fracking revolution in the US; ISIS and oil price collapse in mid-June 2014 that inflicted serious blow to Iraq fiscal, security and developmental efforts; OPEC+ impact on Iraq production; Covid-19 and finally energy/green transition and climate change debate.

However, it is vital to highlight briefly the IOCs that strengthened or weakened their positions during this phase.

In the context of Iraqi GOBPP, strategic positioning is taken here to mean IOCs persistent, competitive, enhanced and long-term underrating in Iraq upstream petroleum. Three dimensions manifest IOC involvement and its strategic positioning: horizontal (in multi-fields), vertical (the participating interest-PI in the fields) and volumetric (in terms of proven reserves and production due to field development).

From November 2013 China began enhancing its presence in the country through consolidating CNPC , CNOOC, ZhenHua , Sinopec , UEG and probably CPECC, which invests in utilizing all associated gas produced in Missan Province . In addition to the above, there are many Chines service companies that are involved in upstream petroleum activities such as drilling, supply and construct surface installations, pipelines, field management among others.

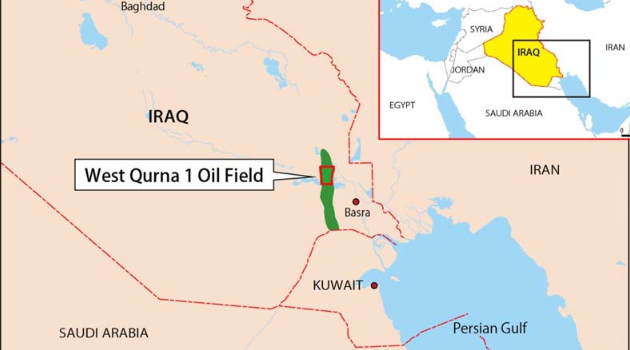

Russian Lukoil enhanced its position vertically horizontally and volumetric in West Qurna 2-WQ2 oilfield and in exploration Block 10 that led to Eridu oilfield discovery; Lukoil found other reservoirs beyond the field’s current borders and thus requested to expand Eridu field. Surprisingly, the Oil Minister reportedly said recently Lukoil intends to sell its PI in WQ2 to a Chines company!

Other Russian IOCs with bid round contracts include Gazprom (operator of Badra oilfield) and Bashneft/ Rosneft (for Exploration Block 12), KRG not included here.

In addition to Chines and Russian IOCs Japanese companies increased their presence as well: Japex (Gharraf oilfield); INPEX (Exploration Block 10/Eridu oilfield) and Itochu bought entire Shell’ PI (20%) in WQ1.

Against the consolidation of the Chines, Russian and Japanese companies, other IOCs lost or weakened their presence in upstream petroleum; these include Big Oil- as ExxonMobil, Shell and Oxy and medium-small size companies such as Petronas, Kogas, Kuwait Energy, TPAO.

Occidental Petroleum relinquished, in 2016, its PI in Zubair oilfield to South Oil Company (now Basra Oil Company), due to its decision pulling out from projects in the Middle East for financial reasons.

ExxonMobil demise began almost ten years ago soon after it had attained significant consolidation; a demise of its own making!! Apart from the contribution of the Iraqi factors ExxonMobil faced and facing many other challenges that exacerbate its decision to abandon Iraq. These include restructuring its international profile; energy transition (away from fossil-based to renewable-energy) environmentally-conscious; shareholder revolts, expulsion of ExxonMobil representative from EITI’MSG due to position regarding Dobb-Franck issue and the forthcoming SEC environmental compliance rules.

Royal Shell story is not very different from that of ExxonMobil. Shell launched initially a powerful strategic positioning, resisted the temptation of engaging with KRG petroleum and diversified its portfolio in oil, gas and petrochemical projects. Now it has much weakened role; withdrew from Majnoon oilfield, sold its PI in WQ1, rumors that it contemplate leaving Basra Gas Compan- BGC , whose HoA was signed in 2008 but it did not deliver the contracted target, and Nibras petrochemical project, with MIM & MoO, draggeed for too many years without any prospect.

Again, Shell decision to leave WQ1 and Majnoon oilfields and possibly BGC was not entirely due to contractual and working conditions in Iraq; one possible explanation relates to Shell’ overall plan to restructure its global business, following its takeover of British Gas Group- BGG. Also Shell faces legal action; A Dutch court ruled, recently, that Shell will have to reduce its carbon emissions by 45 percent from 2019 levels by 2030.

BP has only one engagement- Rumaila oilfield, with almost equal PI with CNPC (while during the June 2009 bidding round BP’ PI was double that of CNPC). Recently, BP decided to spin off its involvement in Rumaila into a stand-alone company, a “ring fencing practice”, for reasons relating to diverting its global assets and investment plans. Though this move is more structural and organizational in nature that has, contractually, no effect on Iraq, it, nevertheless, could indicate possible departure from Rumaila sooner or later.

Total, rebranded TotalEnergies, have very modest PI in only one oilfield- Halfaya, is trying a comeback to Iraq through concluding HoA comprising four major projects, three of which are part of SIIP that Iraq wasted too many years discussing with ExxonMobil!!

Surely, IOCs strategic positioning has significant implications for petroleum sector and the prospect of the entire economy. There has been a tendency for some to be highly selective by focusing only on one Iraqi based, real reason, such as harsh contractual terms; type of contracts; corruption, resource mismanagement and security conditions among others. While all these are real and effective, they are absolutely not the only factors behind IOCs shift and change of priorities as there is a complex wed that one should be aware of; 20 IOCs have recently warned for tax violation and IOCs that lost their strategic positioning inside Iraqi petroleum had themselves contributed to that outcome.

Moreover, global energy/green transition and international geopolitics have powerful ramifications though the debate is, as usual, not conclusive. While IEA recent report could have effective impact, REN21 new report raises doubt; and such wide divergence suggests oil remains needed much longer than some thinks.

Click here to download the full report in pdf format.

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.

The post IOC’s Strategic Positioning in Iraqi Upstream Petroleum first appeared on Iraq Business News.