DNO ASA, the Norwegian oil and gas operator, today announced 2018 net profit of USD 354 million on revenues of USD 829 million, the highest annual revenues in the Company’s 47-year history. Cash flow from operations increased 40 percent to USD 472 million in 2018, of which USD 334 million represented free cash flow.

Operated production averaged 117,600 barrels of oil equivalent per day (boepd) including 81,700 boepd on a Company Working Interest (CWI) basis, up from 113,500 boepd and 73,700 boepd, respectively, during 2017. January 2019 operated production averaged 128,000 barrels of oil per day (bopd) or 90,000 bopd on a CWI basis.

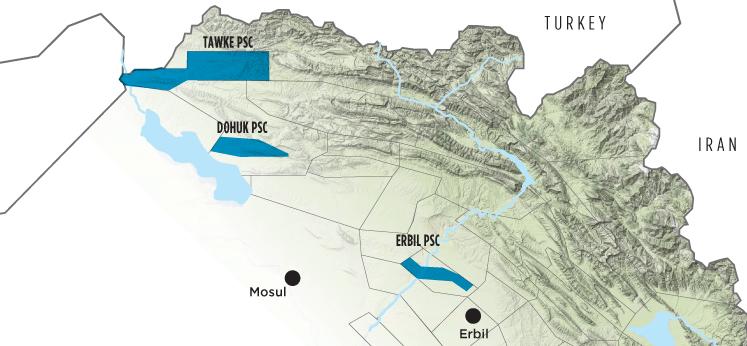

The Company stepped up its operational spend in 2018 to nearly USD 300 million to support the fast-track development of the Peshkabir field in the Kurdistan region of Iraq and the ongoing drilling program at the Tawke field within the same license.

Spending levels in 2019 are projected to rise more than 40 percent from 2018 levels to an estimated USD 420 million. DNO’s 2019 drilling program includes up to 20 exploration and production wells in Kurdistan, including up to 14 wells at the Tawke field, four at Peshkabir and two at the Baeshiqa license. Another five wells are planned in Norway on DNO’s licenses.

In Kurdistan, two recently completed wells, Peshkabir-9 and Tawke-52, will be placed on production in February. Testing of the first Baeshiqa exploration well targeting the Cretaceous reservoir has been delayed by extensive rainfall but is also expected to commence this month.

Already the leading international oil company in Kurdistan, with a 75 percent operating interest in fields contributing a third of the region’s total exports, the Company is now firmly establishing itself in Norway as it completes the takeover of Faroe Petroleum plc. With 90 licenses, of which 22 are operated, DNO will leapfrog to the ranks of the top five companies in total licenses held in Norway.

“The Faroe transaction transforms DNO into a more diversified company with a strong, second leg,” said DNO’s Executive Chairman Bijan Mossavar-Rahmani. “This represents not a pivot away from Kurdistan but a pivot to Norway,” he added. “We are now well positioned in two areas in which we have a comparative, even competitive, advantage.”

The combination places DNO among the top three European-listed independent oil and gas companies in production and reserves.

DNO has acquired more than 96 percent of Faroe shares and initiated the compulsory acquisition of the remaining shares. The integration of the Faroe and DNO organizations is well underway; the new combined entity has over 1,100 employees and offices in Oslo, Stavanger, Erbil, Dubai, London, Aberdeen and Great Yarmouth.

The Company will release pro-forma financials and 2019 investment programs and budgets for the combined entity in February and March.

Separately, DNO’s Board of Directors have approved a dividend payment of NOK 0.20 per share to be made on or about 27 March 2019 to all shareholders of record as of 18 March 2019. DNO shares will be traded ex-dividend as of 15 March 2019.

(Source: DNO)