By Ahmed Mousa Jiyad.

Any opinions expressed are those of the authors, and do not necessarily reflect the views of Iraq Business News.

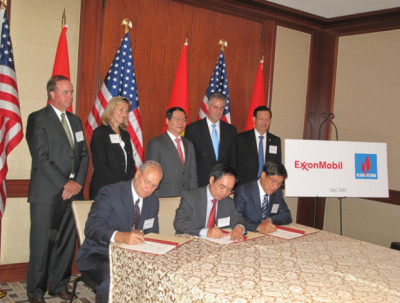

The Ministry of Oil and the “Odious Contract’ Trap” with ExxonMobil’ Consortium

Talks have intensified recently about the continuation of negotiations between the Ministry of Oil (MoO) and ExxonMobil/CNPC consortium that might lead to the signing of a contract for the “South Iraq Integrated Project (SIIP)” at an estimated cost of $53 billion and a duration of 30 years, but no official confirmation or indications on the fundamental contractual provisions that were agreed on and those still pending.

In the light of the available information, material evidence, actual examples, international geopolitical considerations and comparative analysis, a detailed evidence-based research and Report* was done on the project and related negotiation.

The report on SIIP’ possible contract comprises:

- A necessary introduction and caveat;

- Political and geopolitical implications of ExxonMobil behavior and its apparent link to the “deep state” based on many evidences that actually and factually had negative consequences on oil projects, for example, in Russia and in Iraq.

In Russia, ExxonMobil caused a delay of almost four years in the development of the Pobeda oil discovery in the Kara Sea when ExxonMobil withdrew, in late 2014, from its deal with Rosneft due to imposing US sanctions on Russia.

Iraq had three bad experiences with this company in recent years. The first, when ExxonMobil negotiated secretly and concluded, against declared government policy, deals with KRG in 2011 soon after the company secured West Qurna 1 contract through first bid round with the federal ministry.

That move led to excluding ExxonMobil from leading Common Seawater Supply Project (CSSP), reduce its Participating Interest in WQ1 and blacklisting it from any upstream project.

The second and third bad experience occurred this year when the company evacuated, unilaterally and without government consent, all its foreign staff from WQ1. All these three incidents caused tremendous damage to Iraqi economic interest.

- Potential strategic risks, of an enormous scale, on SIIP that could be generate from the growing deterioration of the American-China relations as evidenced from the blacklisting of two major state oil companies, i.e. Zhuhai Zhenrong Corp and Sinopec. US escalating tension against Iran adds further geopolitical risks;

- Analyses of what would be SIIP contract was premised on what was reported by national and international sources that are originally based on information given by unnamed Iraqi officials. That was due to the absence of clarity and lack of transparency of the ministry regarding essential contractual terms and conditions.

Based on the analyses and findings of the report, I am compelled to clearly alert and strongly, frankly and loudly warn both the Prime Minister and the Minister of Oil of the danger of pushing Iraq into a “trap of an odious contract” and by specifying ten of its most grave risks and disadvantages:

- ExxonMobil, as the consortium leader, is granted a monopoly position that allows the company directly controlling all vital oil projects in southern Iraq, and thus the entire national economy, for thirty years;

- It poses a multiplicity of major threats to national security and economic interest due to what can be called contractually-connected high strategic and geopolitical risks, since SIIP comprises many critical and vital projects such as Common Seawater Supply project-CSSP (for water injection), pipelines, storage tank-farms, export facilities, gas processing units and two oilfields;

- It contravenes the fundamental premises of the Iraqi Constitution because the contract requires “mortgaging/ reserving/ booking” two oilfields, with a combined plateau production of 500kbd, exclusively for the two foreign oil companies, i.e. ExxonMobil and CNPC, for the entire term of the contract- 30 years;

- It offers “Profit-Sharing Contract”, which, in reality, represents the monetary side of a “Production Sharing Contracts”, which, is impermissible by the Constitution;

- The announced astronomical cost (of $30bilion) increased already by $11billion in less than ten weeks while negotiating!;

- It offers all rent (windfall) resulting from oil price increases exclusively to the two foreign companies, nothing for Iraq!;

- It prevents SOMO (the only State Oil Marketing Company) from performing its role in marketing crude oil from the “mortgaged” two oilfields; this contravenes established policy, undermines annual state budget laws and weakens almost 50 years of SOMO’s function;

- It reduces the “national efforts” in the development of oilfields, thus, contradicting declared Ministry policy, weakens Iraq’s flexibility to comply with OPEC decisions through “swing fields”;

- Inconsistent with the regulations for tendering and contracting government projects;

- It lacks both transparency and competitiveness.

Therefore, I suggested to the Ministry of Oil not to continue on wasting time and causing further delays: it should officially declare that it is not in Iraq’s economic interest and national security to award SIIP to ExxonMobil-CNPC (and for this matter to any one consortium) and end, immediately, all and any related negotiations.

In the event that the Ministry of Oil and/or the Government insist on going ahead with this Odious Contract with ExxonMobil-CNPC, it becomes inevitable to refer the matter to the Federal Supreme Court to invalidate the contract on the bases of incompatibility with the Constitution; for eradicating the highest interest of the Iraqi people, including future generations (principle of inter-generational equity) and for returning Iraq to what looks like abhorrent concessions of the, colonial, past.

*A brief of the original Arabic text of the entire report was circulated widely within many networks and was published by and posted on many websites, and accessible on the following links:

الحذر يا وزارة النفط من “فخ العقد البغيض” مع شركة اكسون موبل

https://www.akhbaar.org/home/2019/8/261291.html

http://www.tellskuf.com/index.php/mq/83987-as174.html

http://www.sahat-altahreer.com/?p=49115

Click here to download the full article in pdf format.

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.