DNO ASA, the Norwegian oil and gas operator, today announced a tripling of production from the Peshkabir field in the Tawke license in the Kurdistan region of Iraq to 15,000 barrels of oil per day (bopd) following completion of the Peshkabir-3 well testing, stimulation and cleanup program.

A total of 11 zones in a 1.2 kilometer horizontal section of Cretaceous and Jurassic reservoir in the Peshkabir-3 well were individually tested and flowed successfully, of which ten were oil zones and one a gas zone.

The oil zones tested an average of 5,340 bopd per zone on a 64/64″ choke, with the highest individual test rate of 7,200 bopd. A multi-zone combined production test totaled 12,500 bopd on a 128/64″ choke from five zones.

Production from the previously drilled Peshkabir-2 well, in operation since May, together with that of the new Peshkabir-3 well are currently processed through temporary test package facilities and trucked to DNO’s adjacent Tawke field facilities for export.

As previously announced, the Tawke license partners are proceeding with fast track plans to commission an early production facility by yearend and complete installation of pipeline connections early in 2018 to allow ramp up of output at the Peshkabir field.

Preparations are underway to drill the Peshkabir-4 well which will also be designed to test the underlying Triassic reservoir.

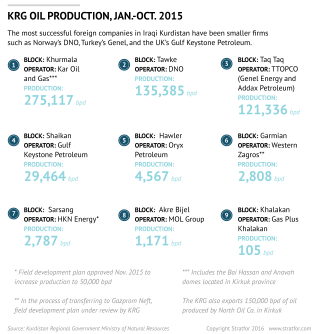

DNO operates and has a 75 percent interest in the Tawke license, with partner Genel Energy plc holding the remainder. The license contains the Tawke and Peshkabir fields whose combined year-to-date production has averaged 110,000 bopd.

(Source: DNO)