Report on Payments to Governments for 2018

This report sets out details of the payments made to governments by Gulf Keystone Petroleum Ltd and its subsidiary undertakings (“Gulf Keystone”) for the year ended 31 December 2018 as required under Disclosure and Transparency Rule 4.3A issued by the UK’s Financial Conduct Authority (“DTR 4.3A”) and in accordance with The Reports on Payments to Governments Regulations 2014 (as amended in 2015) (“the UK Regulations”) and our interpretation of the Industry Guidance on the UK Regulations issued by the International Association of Oil & Gas Producers.

DTR 4.3A requires companies listed on a stock exchange in the UK and operating in the extractive industry to publicly disclose payments to governments in the countries where they undertake exploration, prospection, discovery, development and extraction of oil and natural gas deposits or other materials.

This report is available to download on the Company’s website: http://www.gulfkeystone.com/investor-centre/presentations-and-reports.

Basis for preparation

Total payments below £86,000 made to a government are excluded from this report, as permitted under the UK Regulations.

All of the payments made in relation to the Shaikan Production Sharing Contract (“Shaikan PSC”) in the Kurdistan Region of Iraq have been made to the Ministry of Natural Resources (“MNR”) of the Kurdistan Regional Government (“KRG”).

Production entitlements

Production entitlements are the host government’s share of production during the reporting period from the Shaikan Field operated by Gulf Keystone. The figures reported have been produced on an entitlement basis, rather than on a liftings basis. Production entitlements are paid in-kind and the monetary value disclosed is derived from management’s calculation of estimated revenue.

Royalties

Royalties represent royalties paid in-kind to governments during the year for the extraction of oil. The terms of the royalties are described within the Shaikan PSC. Royalties have been calculated on the same basis as production entitlements.

Taxes

Taxes include taxes levied on the income, production or profits of companies, excluding taxes levied on

consumption such as value added taxes, personal income taxes or sales taxes.

Bonuses

Bonuses include signature, discovery and production bonuses.

Licence fees

These include licence fees, rental fees, entry fees, capacity building payments, security fees and other considerations for licences or concessions.

Infrastructure improvement payments

These include payments for infrastructure improvements, whether contractual or otherwise, such as roads, other than in circumstances where the road is expected to be primarily dedicated to operational activities throughout its useful life.

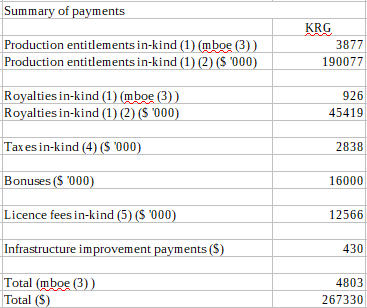

Summary of payments

|

KRG

|

|

Production entitlements in-kind (1) (mboe (3) )

|

3,877

|

|

Production entitlements in-kind (1) (2) ($ ‘000)

|

190,077

|

|

|

|

Royalties in-kind (1) (mboe (3) )

|

926

|

|

Royalties in-kind (1) (2) ($ ‘000)

|

45,419

|

|

|

|

Taxes in-kind (4) ($ ‘000)

|

2,838

|

|

|

|

Bonuses ($ ‘000)

|

16,000

|

|

|

|

Licence fees in-kind (5) ($ ‘000)

|

12,566

|

|

|

|

Infrastructure improvement payments ($)

|

430

|

|

|

|

Total (mboe (3) )

|

4,803

|

|

Total ($)

|

267,330

|

Notes

(1) All of the crude oil produced by Gulf Keystone was sold by the KRG. All proceeds of sale were received by or on behalf of the KRG, out of which the KRG then made payment for cost oil and profit oil in accordance with the Shaikan PSC to Gulf Keystone, in exchange for the crude oil delivered to the KRG. Under these arrangements, payments were made by or on behalf of the KRG to Gulf Keystone, rather than by Gulf Keystone to the KRG. However, for the purposes of the reporting requirements under the UK Regulations, we are required to characterise the value of the KRG’s production entitlements under the Shaikan PSC (for which the KRG receives payment directly from the market) as a payment to the KRG.

(2) The realised prices for crude oil sales remain subject to audit and reconciliation.

(3) Barrels of oil.

(4) Per the Crude Oil Sales Agreement (dated 10 January 2018), road tax is payable on export sales of Shaikan crude oil transported by road from 15 November 2017 until 31 December 2018 at $7/ton. The road tax was paid in kind, as the value of the road tax was deducted in calculating the value of production entitlements payable by the KRG to Gulf Keystone.

(5) No cash payments were made by Gulf Keystone to the KRG. Instead, the value of these fees has been accrued and will be settled with the KRG upon finalisation of the second PSC amendment.

(Source: GKP)