By Ahmed Mousa Jiyad.

Any opinions expressed are those of the authors, and do not necessarily reflect the views of Iraq Business News.

An Integrated Approach for Investment in Joint Development-Unitization for Iraq/Iran Border Petroleum Fields & Exploration Blocks

This article provides brief note in panel discussion and abstract of a keynote PowerPoint presentation prepared for and presented before the 12th International Energy Conference-IEC: Innovative Systems in Energy-Water-Environment Nexus, Tehran, Iran, 19-20 June 2018.

IEC was a cooperation effort between the Iranian National Energy Committee, the International Energy Charter (Treaty) Secretariat, Brussels-ECT and World Energy Council-UK.

My participation was proposed by International Energy Charter Treaty (Secretariat)- ECT, Brussels and I was formally invited, as one of the Key Speakers, by the Iranian National Energy Committee. I am very thankful to both entities for funding my participation.

The aim of the conference was to provide the necessary grounds for specialized and outstanding national and international deliberations, accomplishments and contemporary research activities in energy sector. It comprised, over two days, panels discussions, keynote speeches, scientific research papers, exhibition of innovations and company profiles among others.

I had two contributions in this important gathering: as member in a panel discussion and as a keynote speaker. They are briefly outlined below.

First: The International Panel on Energy Investment and the Environment/ Climate Change

The panel was convened by the International Energy Charter Treaty (Secretariat)-ECT, Brussels and moderated by Dr. Marat Terterov- Principal Coordinator of the ECT.

Panelists include Dr. Urban Rusnak- ECT Secretary General, and international energy experts from Iran, Turkey, Germany, Pakistan and me (from Norway).

The main theme addressed by the panelists was energy investment and the environment, particularly climate change.

Addressing the main theme I began by highlighting three important caveats:

First, climate change is not a new issue; it has been emphasized by the Club of Rome’ monumental book, i.e., Limit to Growth of mid-seventies of last century, and then progressed through many international and regional conferences, protocols, agreements, guidelines, specialized entities among others.

Second, there are at least three interrelated and mutually enforcing levels of concerns or perspectives: international, regional and national.

Third, there is cause-effect-action dynamics that has to be addressed, especially investment that causes environmental degradation and thus requires further investment and technologies for remedial actions.

Then I focused on the national perspective by talking about Iraq and by linking the main theme of the conference Energy-Water-Environment Nexus to the actual development in Iraq’s petroleum sector development and related policy success and failures.

Moving from the national to the regional perspectives, I highlighted the needs for and thus proposed a regional cooperation framework focusing on Energy-Water-Trade-Development comprising countries of Iran, Iraq, Turkey and Syria.

Second: An Integrated Approach for Investment in Joint Development-Unitization of Iraq/Iran Border Petroleum Fields & Exploration Blocks

As one of the keynote speakers my presentation focused on the importance, necessity and working modalities for border fields’ development.

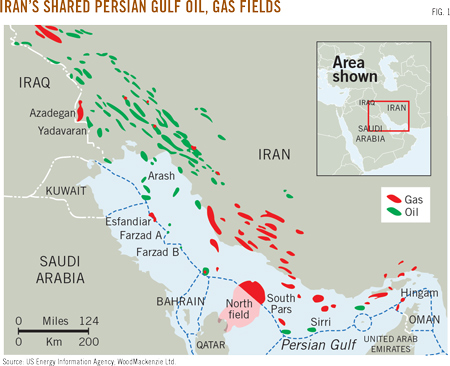

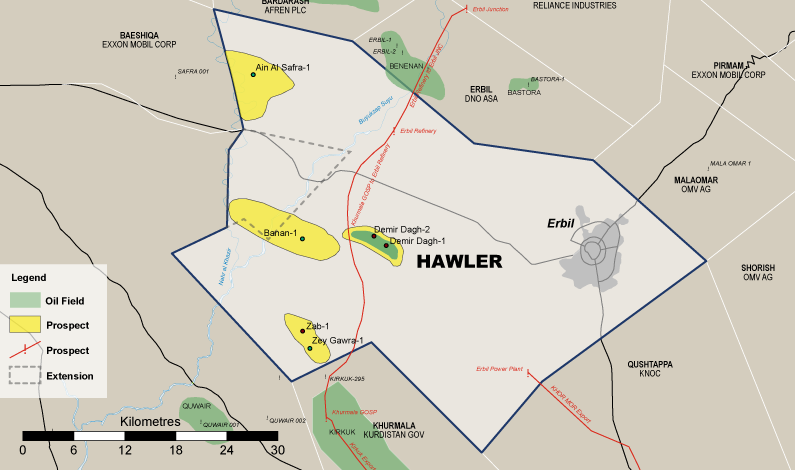

Empirical evidence and analytical premises suggest that sovereign border hydrocarbons fields or exploration blocks could be developed either through “competitive” or “collaborative” strategies; the first follows “rule of capture” or “use it before losing it”, while the second adopts “feasibility & optimization”; the first is harmful to the field, its structure and reservoir(s) while the second adheres to efficiency considerations, prudent natural resource management and international best practices; the first is premised on “sovereign exclusivity” while the second is formulated on “Bi/trilateral inclusivity”; the first is “conflict-prone” while the second serves “mutuality of interests”; the first is “short-term focused” while the second has “phasic orientation” and finally, from investment vs. net revenue perspectives, the first is “own-risk” while the second is “burden and benefit-sharing”.

What should be highlighted is that collaborative development of a border field could be done through two distinct modalities with different investment and revenue structures: unitization (mostly trilaterally structured) and joint venture (mostly bilaterally structured).

Institutional and managerial setups are, by necessity, a top-down multi-layered structures; from “top-sovereign” through “macro” to “sectoral” to “sub-sectoral” to lowest operational “micro-project” levels. That indicates border fields development is, apparently, an issue characterizes with complexity and inter-connectivity and, consequently requires, from sovereign parties, holistic approach with clear Vision, competent integrated Mission and specific practical Actions. Hence, joint development arrangements and operational modalities of border fields or exploration blocks are lengthy, difficult, legally complex and politically sensitive. Thus, as prerequisite for protecting the national interests of the sovereign parties it is vital to formulate specific strategy and adopt well thought integrated approach or roadmap for jointly developing the fields across Iraq-Iran borders.

For this purpose the presentation proposes Strategy Outcomes Matrix-SOM and related TELG Approach; while SOM elaborates on the mentioned above thoughts, TELG Approach basically integrates four fundamental broad spheres of professional knowledge-base and analysis and applicable to the collaborative mode of border fields development in both modalities- unitization and joint venture:

Technical (including technological, engineering, geological and related petroleum specializations, which should provide all related structural, volumetric and qualitative parameters, data and analysis including thorough Situation Analysis and Base-Line Survey );

Economic (including assessing investment options, sensitivity analysis, economic and financial feasibility assessment based on Equity shares, Capex, Opex, existing Assets valuation and provides thorough cash-flow analysis among others);

Legal (including governing frameworks, contract type or contracting modalities and related approvals; Pre-unitization Agreement/ Unitization Operation Agreement);

Geo/political (including bilateral and international instruments, norms and standards pertinent to the subject matter. For Provincial/ Regional blocks it covers domestic political issues relating to resource development and management).

The main components of these four pillars of TELG Approach have to be thoroughly and comprehensively analyzed and their significance and implications highlighted.

For this purpose the presentation suggests TELG-SCOR analysis (SCOR stands for Strength, Challenges, Opportunities and Risks for each TELG components) that both countries might need to explore.

TELG Approach, by its very nature, requires multi-layered integrated-team working of relevant and related specializations and expertise comprising:

Authorizing and Coordinating Committee-ACC (high-level decision making on the Ministry’s level with formal reporting obligations to the Cabinet and the Parliament);

Team Leader-TL (with track record of petroleum professional competence and international negotiation skills);

Supportive Working Group(s)-SWGs (comprising members with distinct knowledge in their own field of knowledge and specialization) and representatives from the related field or exploration block such as the State Partner and the contracted Consortium/IOC.

The main functions, working procedures, modus-operandi and role of each group in the team working need careful identification and adherence.

Also, the application of TELG approach takes into consideration the status of the related border field/block; accordingly, there could be many scenarios depending on the assessment of the joint border field/block. This calls for “Special” version of Unitization Agreement.

Both countries, Iraq and Iran, have in recent years invigorated their efforts for boarder fields’ development and, moreover, assigned “strategic” importance and grant priority to these fields. At the same time both countries endeavored to pursue joint modalities in such development.

The presentation provides a list of worldwide unitization agreements and hypothetical illustrative example on a unitization case study.

Hence, this contribution is timely, relevant and helpful. The presentation was through PowerPoint slides, uses formal and official sources for data and information.

My PowerPoint slides are available upon direct request.

The Conference website is http://irannec.com/English/default.aspx

Key Speakers and titles of their presentations are listed through http://irannec.com/English/83-Key-Speakers

Norway

25 June 2018

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.