Floating Oil Island will handle Iraq’s expected Spurt in Exports

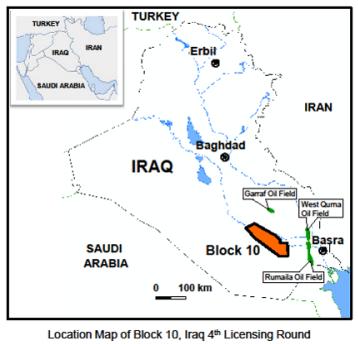

The South Oil Co. (SOC), based in Basra, Iraq, will establish a floating oil island off the coast of al-Faw Peninsula to increase its export capacity by as many as 2 million barrels a day.

The company announced the project June 14 in anticipation of a surge in Iraqi oil exports to reach 5-6 million barrels per day. Indeed, OPEC on June 23 approved an increase in crude oil output to meet growing demand.

Hamzah al-Jawahiri, an Iraqi Oil Ministry consultant, explained that Basra province has five floating terminals overlooking the Arab Gulf for commercial work and two fixed offshore terminals at Khor al-Amiyah and al-Basra dedicated to loading about 80% of Iraq’s oil exports.

He told Al-Monitor, “All of these terminals require technical and administrative staff working around the clock. The ministry noted the need for more flexibility, as work will double in the future with the increase in oil and oil derivatives output. This requires additional technical, logistical and human support that can be provided by the oil island project near the seven Iraqi terminals. The project will facilitate shift work and the delivery of services with no interruption caused by [outside] emergency disruptions, human errors or terminal platforms oil spills.”

Jawahiri revealed that the island will include a spare-parts warehouse for all equipment and pumps, in addition to civil protection and technical services teams, as well as comfortable and modern accommodations for workers. “The floating island will spare Iraq work delays due to possible failures,” he said. “It will save time when it comes to oil export and prevent any emergency crisis caused by the disruption of any of the pumps. Recently, Iraq has paid delay penalties of about 300 million Iraqi dinars [about $252,300].”

He said the island will provide storage capacity for oil derivatives, black oil and refinery waste. “The island is linked to jetties and will provide a ready alternative in the event of disruption of any of the seven terminals.”

A source in the oil company’s media office told Al-Monitor, “The project will … also provide other services, such as anchoring and launching oil tankers and ensuring their technical and logistical support. Tankers will be filled with oil stored on the island in sufficient quantities.”

Jawahiri said a contract has been awarded to a Dutch company regarding the island project, including a preliminary agreement, but he provided no further details other than to say discussions are ongoing about the completion period and expected costs.

However, Alaa al-Yasiri, the director general of the State Organization for Marketing of Oil (SOMO), told Al-Monitor, “The contract is expected to be signed in the first quarter of 2019, with operation at partial capacity set for the first quarter of 2022. All services will be provided in the fourth quarter of 2022.”

He added, “Iraq is in dire need of expanding its export outlets. Its services must be in line with modern technology, and it must be able to cope with the potential oil and oil derivatives increase. SOMO’s new plans include joint projects with Asian companies to invest in the continent’s vast market. The Asian market consumes 60% of Iraqi oil exports. … The Ministry of Oil wants to turn SOMO into a profit-earning company. The floating oil island will help achieve this.”

Oil Ministry spokesman Assem Jihad said the project coincides with plans to build a national tanker fleet to transport oil and oil derivatives. “It is also in line with plans to restore the capabilities of the Iraqi Oil Tankers Co. to transport crude oil and oil derivatives to all parts of the world.”

Jihad said the island will help Iraq transfer oil to consumers via four giant tankers. “Three other tankers will be added at later stages,” he said.

Some experts worry about the coming increase in oil output. Oil projects expert Mohammed Zaki Ibrahim told Al-Monitor, “Experiences proved that sporadic increases in crude oil output offered for sale on global markets does not serve the Iraqi economy. Increasing exports above 3 million or 4 million barrels per day will harm Iraq gravely and deny it any opportunity to develop other resources. This also will deplete oil resources in the south.”

Meanwhile, Iraq urgently needs financial resources, with its deteriorating economy and a suffering agriculture sector. The floating island will provide hundreds of jobs, limit export delays and reduce the cost of transporting oil and derivatives.