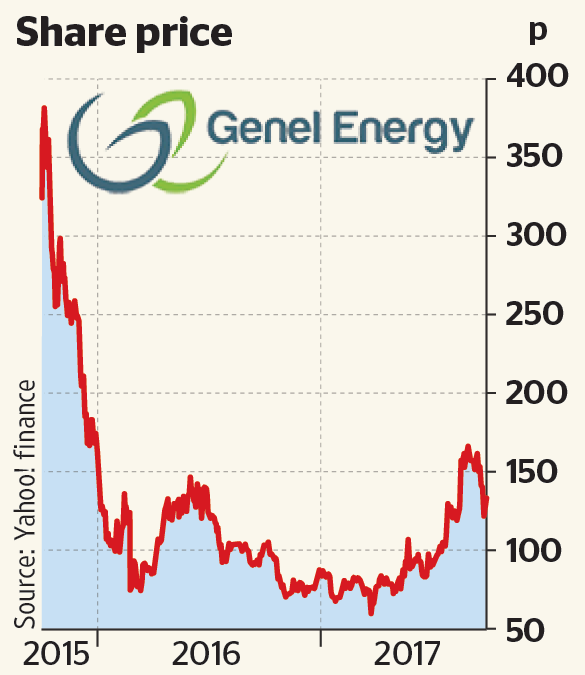

Shares in Genel Energy closed up nearly 7 percent on Friday after the company reported increased production in its operations update for the third quarter and first nine months of 2019. The information contained herein has not been audited and may be subject to further review.

Bill Higgs (pictured), Chief Executive of Genel, said:

“We continue to deliver on our strategy. Robust production is generating material free cash flow, which we are recycling into low-risk and quick returning projects, with good progress made on delivering key milestones on schedule for both Sarta and Qara Dagh.

“Rapid payback from our low break-even assets gives us resilience and significant flexibility in regard tofuture capital allocation. The sustainability of our cash-generation provides opportunities to deliver material shareholder value through investing in growth and increasing returns to shareholders.“

FINANCIAL PERFORMANCE

- $287 million of cash proceeds received as of 30 September 2019, of which $120 million was received in Q3

- Free cash flow of $121 million in the first nine months of 2019,with capital expenditure of $110 million

- Cash of $413 million at 30 September 2019 ($281 million at 30 September 2018)

- Net cash of $115 million at 30 September 2019 (net debt of $16 million at 30 September 2018)

OPERATING PERFORMANCE

- Net production averaged 36,530 bopd in the first nine months of 2019, an increase of 12% year-on-year, in line with guidance

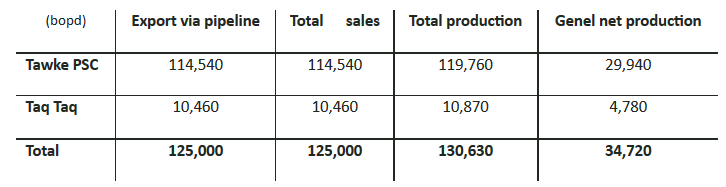

- Production in Q3 averaged34,720 bopd (33,700 bopd in Q3 2018)

- 11 wells have been placed on production in 2019, with a further five wells expected to add to production in the remainder of the year

- Production and sales by asset during Q3 2019 were as follows:

PRODUCTION ASSETS

- Tawke PSC (Genel 25% working interest)

- Tawke PSC production averaged 119,760 bopd in Q3 (113,100 bopd in Q3 2018), including a contribution of 51,940 bopd from the Peshkabir field

- Production was impacted by a workover of the P-2 well and side-track of the P-3 well at the Peshkabir field, with the latter well expected to come onstream shortly

- The Tawke-57A deep well to appraise the Jurassic was spud in August 2019 with testing to commence shortly. The Tawke-59 Cretaceous well spud in October 2019 and is expected to come on production later this month, with two Jeribe wells, Tawke-61 and Tawke-62 also set to be placed on production shortly

- Four additional Jeribe wells are planned to spud by year-end

- The operator expects to exit the year with Tawke licence production averaging 120,000 bopd and to maintain this rate into 2020

- Taq Taq PSC (Genel 44% working interest and joint operator)

- Taq Taq field production averaged 10,870 bopd in Q3 2019 (12,200 bopd in Q3 2018)

- Following the successful completion of the TT-19 well, which is currently flowing at a rate of c.1,500 bopd, current production from the Taq Taq field is just under 11,000 bopd

- The TT-34 well is currently drilling and is scheduled to complete later this month. The rig will then move to drill TT-35, which is set to spud in December and is targeting production from the northern flank of the field

PRE-PRODUCTION ASSETS

- Sarta (Genel 30% working interest)

- Civil construction work at the Sarta field completed on schedule in October 2019, and work on the construction of the 20,000 bopd central processing facility (‘CPF’) has now begun

- Commissioning of the CPF and production are on track to begin in the middle of 2020

- Phase 1A represents a low cost pilot development of the Mus-Adaiyah reservoirs, designed to recover 2P gross reserves of 34 MMbbls

- Unrisked gross mid case resources relating to the Mus-Adaiyah reservoir only are estimated by Genel at c.150 MMbbls, with overall unrisked gross P50 resources currently estimated by the Company at c.500 MMbbls

- Qara Dagh (Genel 40% working interest and operator)

- Genel has signed a contract with Parker Drilling for the drilling of the QD-2 well, and civil construction works are underway in preparation for the upcoming drilling operations

- The well will test the structural crest 10 km to the north-west of the QD-1 well, which tested sweet, light oil from Cretaceous carbonates

- The QD-2 well is on track to spud in H1 2020

- Unrisked gross mean resources at Qara Dagh are currently estimated by Genel at c.200 MMbbls

- Bina Bawi (Genel 100% and operator)

- Negotiations between Genel and the Kurdistan Regional Government continue to progress regarding commercial terms for the gas and oil development at Bina Bawi

- In parallel with these negotiations, Genel is completing the necessary readiness work required to enable rapid progress towards gas and oil developments upon agreement of the commercial terms

- Genel is confident of a positive outcome to these commercial discussions

- Somaliland

- Onshore Somaliland, Stellar Energy Advisors has been appointed to run the farm-out process relating to the SL10B13 block (Genel 75% working interest, operator)

- Interpretation of the 2018 2D seismic data together with basin analysis has identified multiple stacked prospects, with each of them estimated to have resources of c.200 MMbbls

- A further program of surface oil seep sampling and analysis reiterates the presence of a working petroleum system on the block

- It is estimated that a well designed to test multiple stacked prospects could be drilled for c.$30 million gross

- Morocco

- On the Sidi Moussa block offshore Morocco (Genel 75% working interest, operator), processing of the multi-azimuth broadband 3D seismic survey acquired in 2018 over the prospective portions of the block is nearing completion

- The farm-out campaign is on track to begin in Q1 2020, aimed at bringing a partner onto the licence prior to considering further commitments

OUTLOOK AND 2019 GUIDANCE

- Net production guidance in 2019 maintained at close to Q4 2018 levels of 36,900 bopd

- 2019 capital expenditure guidance maintained towards the top end of the $150-170 million range

- Interim dividend of 5¢ per share to be paid on 8 January 2020 to shareholders on the register as of 13 December 2019

- Given the ongoing strength of cash generation and the positive outlook for the Company, Genel reaffirms its commitment to growing the dividend

- The Company continues to actively pursue growth and is assessing opportunities to make value-accretive additions to the portfolio

(Source: Genel Energy)