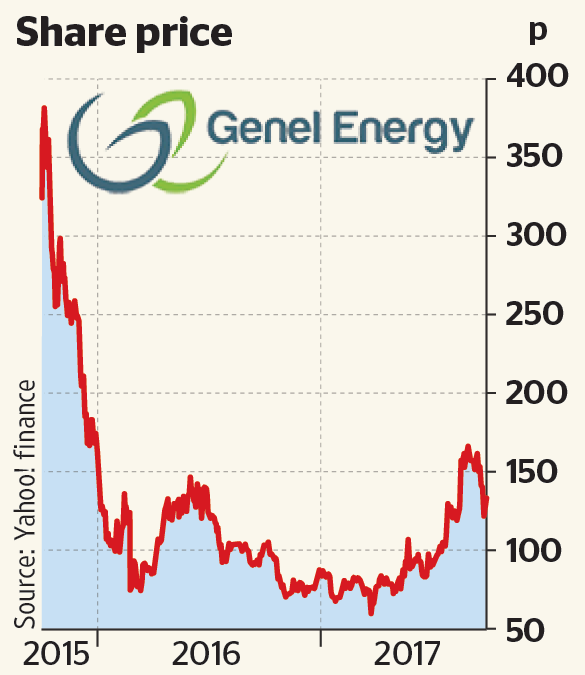

Genel Energy has announced a return to profit.

In its audited results for the year ended 31 December 2017, Murat Özgül (pictured), Chief Executive of Genel, said:

“Another year of consistent payments by the KRG and a disciplined capital allocation strategy helped to generate material free cash flow in 2017. This was enhanced in the latter part of the year by the Receivable Settlement Agreement, from which Genel expects to generate sustainable and significant free cash flow going forward.

“The strong financial performance of 2017, and the promise of more to come, facilitated the successful refinancing in December, which solidified a significant improvement in the balance sheet and provides a strong platform for growth.

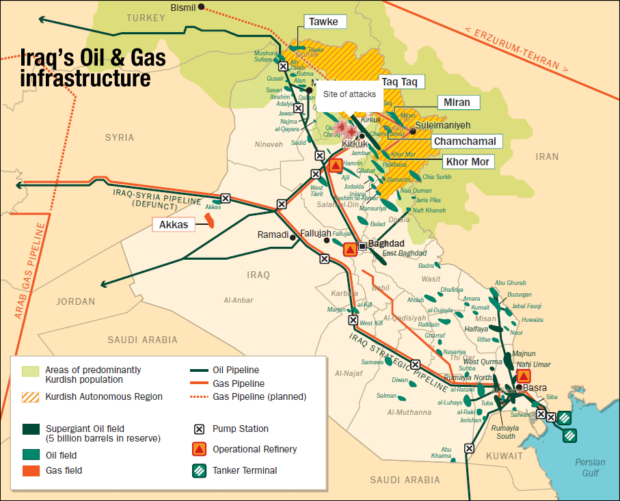

“We will continue with our strategy of maximising free cash flow as we focus investment on our producing assets, specifically on the Tawke PSC, where the performance of Peshkabir remains highly encouraging. Prudent expenditure will also be made on the other assets within our portfolio that provide material value creation opportunities.

“We will continue to construct the building blocks for value creation from Bina Bawi and Miran, while cost-effectively progressing our exploration assets in Africa.”

Results summary ($ million unless stated)

|

|

2017 |

2016 |

|

|

|

|

|

Production (bopd, working interest) |

35,200 |

53,300 |

|

Revenue |

228.9 |

190.7 |

|

EBITDAX1 |

475.5 |

130.7 |

|

Depreciation and amortisation |

(117.4) |

(128.9) |

|

Exploration expense |

(1.9) |

(815.1) |

|

Impairment of property, plant and equipment |

(58.2) |

(218.3) |

|

Impairment of receivables |

– |

(191.3) |

|

Operating profit / (loss) |

298.0 |

(1,222.9) |

|

Cash flow from operating activities |

221.0 |

131.0 |

|

Capital expenditure |

94.1 |

61.2 |

|

Free cash flow before interest2 |

141.8 |

59.1 |

|

Cash3 |

162.0 |

407.0 |

|

Total debt |

300.0 |

674.6 |

|

Net debt4 |

134.8 |

241.2 |

|

Basic EPS (¢ per share) |

97.1 |

(448.6) |

|

|

|

|

1. EBITDAX is earnings before interest, tax, depreciation, amortisation, exploration expense and impairment which is operating profit / (loss) adjusted for the add back of depreciation and amortisation ($117.4 million), exploration expense ($1.9 million) and impairment of property, plant and equipment ($58.2 million)

2. Free cash flow before interest is net cash generated from operating activities less cash outflow due to purchase of intangible assets and purchase of property, plant and equipment (oil and gas assets only)

3. Cash reported at 31 December 2017 excludes $18.5 million of restricted cash

4. Reported debt less cash

Highlights

- $263 million of cash proceeds received in 2017 (2016: $207 million), with strong free cash flow generation of $142 million (2016: $59 million)

- Year-end net debt of $135 million, a 44% reduction year-on-year (2016: $241 million)

- Year-end gross debt of $300 million, a 56% reduction year-on-year (2016: $675 million), with debt extended until 2022 and interest cost reduced by 40%

- Receivable Settlement Agreement resulted in cash benefit of $26 million in Q4 2017

- Focused capital allocation – 66% of capital expenditure was spent on cash-generative producing assets, and has been cost recovered

- Drilling success at Peshkabir, with gross production rising to c.15,000 bopd at year-end

- Taq Taq field production stabilised in H2 2017, with Q4 average of 14,035 bopd in line with Q3 average of 14,080 bopd

- In January 2018 Bina Bawi and Miran CPRs confirmed c.45% uplift to gross 2C raw gas resources to 14.8 Tcf

Outlook

- Combined net production from the Tawke and Taq Taq PSCs during 2018 is expected to be close to Q4 2017 levels of 32,800 bopd, unchanged from previous guidance

- Genel expects to continue the generation of material free cash flow in 2018

- Tangible steps to be taken to further de-risk gas resources and unlock value from Bina Bawi and Miran, including the high-value oil resources

- Capital allocation discipline to continue, with ongoing prioritisation of spend on cash-generative producing assets. Capital expenditure guidance unchanged at c.$95-140 million net to Genel

- Opex and G&A cash cost guidance unchanged at c.$30 million and c.$15 million respectively

(Source: Genel Energy)