Iraqi Oil Minister Jabar Ali al-Luaibi [Allibi, Luiebi] said on Sunday that a deal signed with Tehran to swap up to 60,000 barrels per day of crude produced from the northern Iraqi Kirkuk oilfield for Iranian oil is for one year.

“This is an agreement for one year and then we will see after that whether to renew it,” Luaibi told reporters in Kuwait City on the sidelines of an Arab oil ministerial meeting, Reuters reported.

The agreement signed on Friday by the two OPEC countries provides for Iran to deliver to Iraq’s southern ports “oil of the same characteristics and in the same quantities” as those it would receive from Kirkuk.

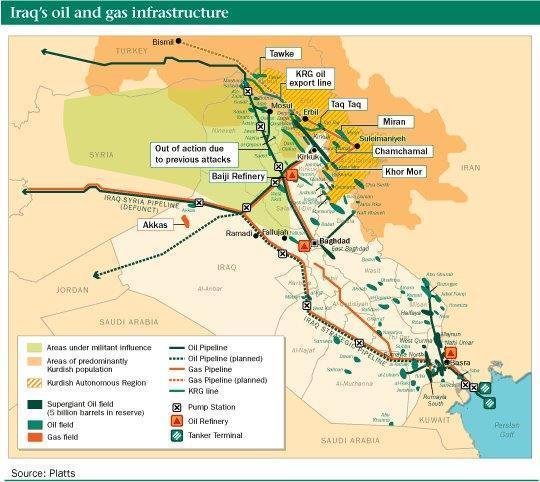

The deal in effect allows Iraq to resume sales of Kirkuk crude, which have been halted since Iraqi forces took back control of the fields from the Kurds in October.

Between 30,000 and 60,000 bpd of Kirkuk crude will be delivered by tanker trucks to the border area of Kermanshah, where Iran has a refinery.

The two countries are planning to build a pipeline to carry the oil from Kirkuk, so as to avoid trucking the crude.

The pipeline could replace the existing export route from Kirkuk via Turkey and the Mediterranean by pipeline.

(Sources: Tasnim, under Creative Commons licence; Iraqi Ministry of Oil)