By John Lee.

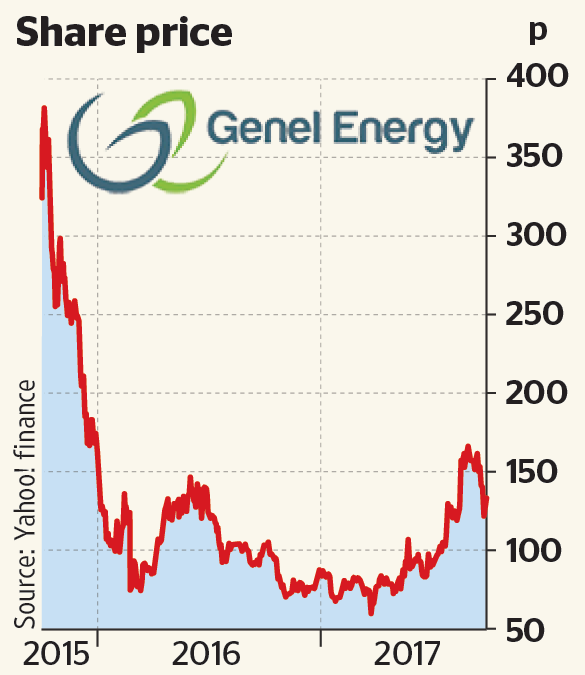

Shares in Genel Energy were trading down around 5 percent on Tuesday morning, despite significant increases in revenue and profit announceed in its unaudited results for the six months ended 30 June 2022.

Paul Weir, Interim Chief Executive of Genel, said:

“Our cash generation in the first half of the year has been exceptionally strong – driven by our low-cost, high-margin oil production and disciplined capital allocation. We remain focused on the delivery of our long-established strategy of putting capital to work to grow our production and cash generation, while retaining our resilience and paying a material and progressive dividend.

We generated $129 million in free cash flow and are well on track to generate over a quarter of a billion dollars of free cash flow for the full year. This continues to build our balance sheet strength and optionality, providing us with the funds to add the right assets at the right price. Our cash flow this year benefits from the recovery of receivables and our override payments, and we are focused on replacing these by building a portfolio that supports the resilience, sustainability, and progression of our material dividend.“

Results summary ($ million unless stated)

| H1 2022 | H1 2021 | FY 2021 | |

| Average Brent oil price ($/bbl) | 108 | 65 | 71 |

| Production (bopd, working interest) | 30,420 | 32,760 | 31,710 |

| Revenue | 245.6 | 151.5 | 334.9 |

| EBITDAX1 | 212.3 | 123.1 | 275.1 |

| Depreciation and amortisation | (84.4) | (81.8) | (172.8) |

| Impairment of oil and gas assets | – | – | (403.2) |

| Reversal of impairment of receivables | 12.8 | – | 24.1 |

| Operating profit / (loss) | 140.7 | 41.3 | (276.8) |

| Cash flow from operating activities | 216.3 | 91.1 | 228.1 |

| Capital expenditure | 74.7 | 58.2 | 163.7 |

| Free cash flow2 | 128.7 | 22.2 | 85.9 |

| Cash | 412.1 | 266.4 | 313.7 |

| Total debt | 280.0 | 280.0 | 280.0 |

| Net cash / (debt)3 | 141.3 | (2.2) | 43.9 |

| Basic EPS (¢ per share) | 45.4 | 9.3 | (111.4) |

| Dividends declared for the period (¢ per share) | 6 | 6 | 18 |

- EBITDAX is operating profit / (loss) adjusted for the add back of depreciation and amortisation, impairment of property, plant and equipment, impairment of intangible assets and reversal of impairment of receivables

- Free cash flow is reconciled on page 8

- Reported cash less IFRS debt (page 8)

Summary

- Material cash generation from low-cost and high-margin oil production:

- Net production averaged 30,420 bopd in H1 2022 (H1 2021: 32,760 bopd)

- Low production cost of $4.4/bbl and strength of oil price delivered a margin per barrel of $32/bbl (H1 2021: $20/bbl)

- Free cash flow of $129 million (H1 2021: $22 million)

- Financial strength provides options for capital allocation:

- $75 million of capital expenditure in H1 2022, of which $41 million was spent at Taq Taq and Tawke, and $27 million on Sarta appraisal

- Genel took on operatorship at Sarta on 1 January 2022, with Sarta-5 and Sarta-1D subsequently being completed

- Cash of $412 million (31 December 2021: $314 million)

- Net cash of $141 million (31 December 2021: net cash of $44 million)

- A socially responsible contributor to the global energy mix:

- Zero lost time injuries (‘LTI’) and zero tier one loss of primary containment events at Genel and TTOPCO operations

- Two million work hours since the last LTI, as we seek to repeat the performance of six years without an LTI up to September 2021

- As we mark 20 years of operations in the Kurdistan Region of Iraq (‘KRI’), the Genel20 Scholars initiative has launched, with Genel funding the opportunity for 20 economically disadvantaged students to have a life-enhancing education at the American University of Kurdistan

- Zero lost time injuries (‘LTI’) and zero tier one loss of primary containment events at Genel and TTOPCO operations

Outlook

- Production guidance for 2022 maintained as around the same level as 2021, currently tracking between 30-31,000 bopd for the full-year

- 2022 capital expenditure guidance of between $140 million and $180 million tightened to $150 million to $170 million

- Genel expects free cash flow of over $250 million in 2022, pre dividend payments

- Appraisal at Sarta is ongoing, with results of the Sarta-6 well expected around the end of the year

- The Company continues to actively pursue new business opportunities, focused on production and cash generation

- The London seated international arbitration regarding Genel’s claim for substantial compensation from the KRG following Genel’s termination of the Miran and Bina Bawi PSCs is ongoing

- Interim dividend retained at 6¢ per share:

- Ex-dividend date: 15 September 2022

- Record date: 16 September 2022

- Payment date: 14 October 2022

(Source: Genel Energy)

The post Genel Energy: Strong Results, but Shares Down first appeared on Iraq Business News.