By Elena Kornienko.

Little did I know back in 1999 when I got my first job in procurement on the Sakhalin-2 project which became one of the mega projects in oil and gas industry not only in Russia but also worldwide.

I was young, ambitious and also very naive about what years later became my biggest passion. Procurement, Purchasing, Supply Chain – various organizations use different names for this function, but the truth about it is very simple – we do impact the production of our companies as a Superman hero, and also are treated internally as a Cinderella.

My first boss worked very hard – we could see him already in the office when we arrived. He was the last one to leave and always spent at least one weekend day at his desk catching up with all the requisitions, purchase orders and expediting reports. It was the first offshore platform in Russia, with nternational standards and a limited presence of contractors and suppliers who could help us, the Procurement team, to deliver goods and services to our internal client, the Production team.

I started working with a strong believe that no matter how hard you work, how many hours you spend in the office, how many phone calls and emails you do every day, there will be always someone to blame Procurement for a delay. Our cruel “stepmother” and jealous “stepsisters” from the Production and Drilling teams constantly mistreated us by giving more and more unrealistic requisitions. Perhaps it was not that bad, but it felt like we are given impossible tasks.

Years later I realized that this was not bad treatment of the Procurement team, but rather a challenge for us to rise and shine. This challenge was accepted by us as we knew that there would not be a Fairy Godmother to make a change. The change has to come first from understanding that tne Procurement function brings the value for all levels of the organization.

Today’s focus is on sustainability as well as ethical and environmental factors, and the supply chain organization needs to ask itself “why” questions before any action. Why procurement makes this decision and why it is important to the organization. Why its sourcing strategy is like that and not anything else. Why the company spends that money on procuring goods or services. Why, why, why…. I will be answering these and so many other questions related to procurement in the blog articles here at Iraq Business News.

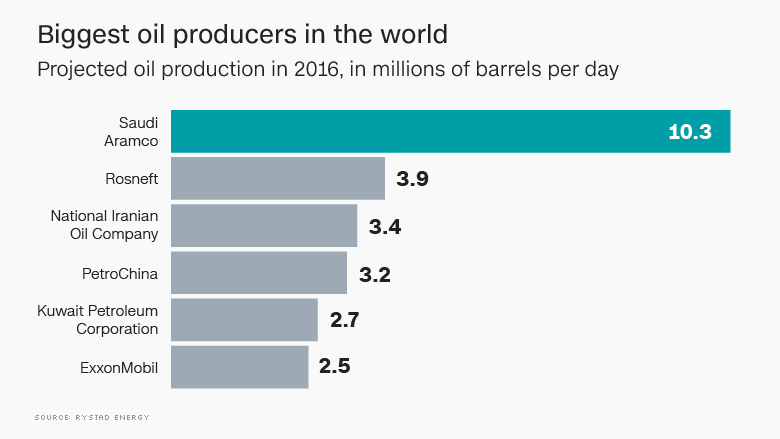

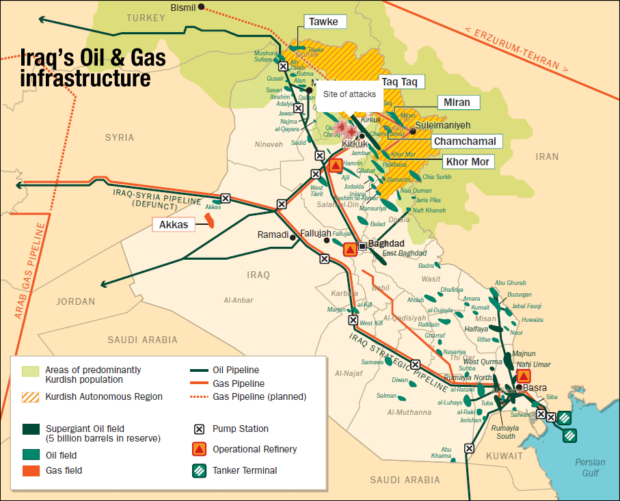

However, lets get back to the question “Is Procurement a Cinderella or a Superman?”. It is no secret that Iraq’s economy is dominated by the oil sector and most of the oil exploration and production is done by International Oil Companies (IOCs). It is estimated that on average between 70% and 80% of a company’s spend is related to procurement activities for purchasing of goods or services. That is quite impressive, right? And of course, the procurement process is regulated by the internal procedures.

It is questioned wherever regulations governing public procurement in Iraq apply to procurement procedures of the IOCs in relation to their subcontracts or not. And while it is debatable if procurement regulations and instructions are applicable to subcontracts or not, IOCs follow their internal procedures to govern the procurement process. What not everyone realizes is that procurement procedures always have room for improvement.

Very often the whole procurement process – from demand identification up to contract award – is quite lengthy and not always transparent to potential contractors. In the articles to come we will be reviewing all processes related to procurement and how they are applicable to IOCs operating in Iraq.

Elena Kornienko has more than 15 years of professional experience in contracts, procurement and tendering in various roles from demand-identification to contract close-out. She has worked on major international oil and gas projects, including the Sakhalin-1 and Sakhalin-2 fields in Russia, and Iraq’s West Qurna-2. Now based in Dubai, she provides consultancy services to the oil and gas industry. Elena is a fluent English and Russian speaker, and a graduate of the Moscow State University of Commerce, holding a degree in Economics. She also graduated with distinction from the School of Business Administration at Portland State University and holds a CIPS diploma.