By Alessandro Bacci.

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News.

The Ministry of Oil has repeatedly said that it would like to renegotiate the terms of its service contracts with the international oil companies (IOCs) to link the fees the companies receive for developing the fields to the oil prices and to have them share the burden when oil prices decrease.

However, discussions between the federal government and the IOCs have been going on for the past two years with no tangible results until now. Companies affirm that they have submitted some recommendations, but then the process has not moved on.

At this point, it seems that to have a successful fifth licensing round, the federal government must produce in the coming months a new model contract (or at least an amended version of the present technical service contracts) capable of satisfying according to different price levels both the government and the IOCs.

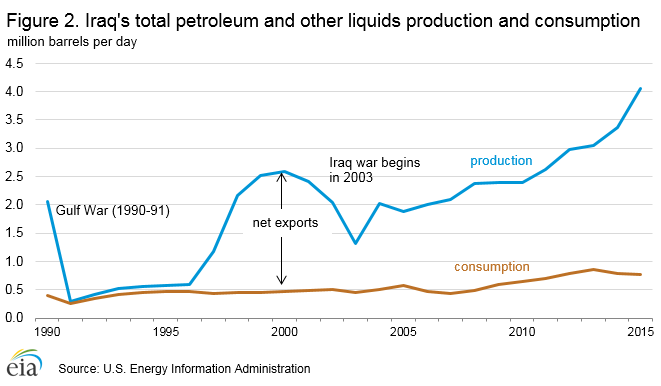

Otherwise, it’s difficult for Iraq to reach the production target of 6 million bpd of crude oil by 2020, especially if other neighboring countries might soon offer better contractual terms.

Please click here to download the full report.

Alessandro Bacci is an independent energy consultant in relation to business strategy and corporate diplomacy (policy, government, and public affairs). Much of his activity is linked to the MENA region, an area where he lived for four years. Alessandro is now based in London, United Kingdom (www.alessandrobacci.com). A multilingual professional, Alessandro holds a Bachelor of Laws and Master of Laws from the University of Florence (Italy), a Master in Public Affairs from Sciences Po (France), and a Master in Public Policy from the Lee Kuan Yew School of Public Policy (Singapore).