By Ahmed Mousa Jiyad.

Any opinions expressed are those of the authors, and do not necessarily reflect the views of Iraq Business News.

The Fifth Energy Bidding Round: Poor Management, Dubious Contracts and Bad Results – Attracted Unprecedented Opposition

Prominent Iraqi oil experts and professionals drafted and endorsed a unified position’ statement (UPS) addressed to the three Presidencies; of the Republic, of the Cabinet and of the Parliament.

The UPS provides thorough assessment of both the outcome of this bid round and related dubious two model contracts; it opposes and rejects the results and calls upon the Presidencies not to ratify any contracts relating to this bid round. The UPS, written in Arabic, was disseminated widely inside Iraq and was posted on 9 May onwards on many websites.

Most of the 31 Iraqi oil experts who issued, and their names appears in, the UPS have many decades of leading positions and extensive work experience in the petroleum sector.

For nearly ten years, this is the first time that so many well-known and respected petroleum technocrats come together to issue a unified, strong and specific statement. This in fact is a manifestation of their concern on the gravity of the danger that could undermine the national interest by these contracts and those behind them.

UPS came as a culmination of individual and collective efforts and contributions that were provoked by the fact that these contracts offer unprecedented concessions to the IOCs in post 2003 Iraq, especially when the model contracts were posted and analyzed.

In addition to been the Coordinator for UPS, I wrote a series of contributions (in Arabic) and shared them with my very extensive network of contacts as well as posting them on many websites for wider readership.

There was considerable attention to this bid round since it was first perceived by the Ministry of Oil-MoO in July last year (

http://www.iraq-businessnews.com/2017/07/21/important-oil-projects-dubious-non-transparent-contracts/ ) but the recent debate had actually impacted directly by the sequence of events pertaining to the bid round.

Much of the concerns prior to holding the bidding focused primarily on the “secrecy of the contracts”. MoO announced on 13 April it has prepared two model contracts: The first is for the already discovered and, some, producing oilfields- Development and Production Contract (DPC); and the second is for the exploration blocks- Exploration, Development and Production Contract (EDPC).

The Ministry said it sent the two model contracts together with the Final Tender Protocol-FTP and Bidding Information to the IOCs that bought data package.

But the Ministry broke with its transparent practices, followed by the previous bid rounds, of announcing and posting the model contracts, the FTP and bidding information well ahead of the bid round. This time, it did not. And when I asked why, their answer was it is a matter of “confidentiality”.

That prompted me to not only refuting the confidentiality alibi based on comparative assessment with past practices, but also put that within the environment of secrecy and non-transparency that dominates the ministry since the last ministerial shakeup of August 2016 (see my article in Arabic سرية عقود وزارة النفط ومخالفتها للتوجيهات؛ لماذا ولمصلحة من؟

http://www.akhbaar.org/home/2018/4/243077.html posted on 17 April 2018)

As usual, I posted the above article to my network, including one particular list comprising the three presidencies, senior officers at the Council of Ministers, former oil ministers and most seniors at the ministry of oil. This list witnessed an exchange of lengthy emails between the DG of PCLD at the MoO, Abdul Mahdy Al-Ameedi, and I.

The bidding round finally took place on 26 April. The formal announcement by the MoO was extremely brief and just mentioned a few names of IOCs. One contact posted to me the actual bids on each “area”, by whom, who were the winners, what was the bidding parameter that was announced by the Ministry prior to each bid and other information.

Based on the communicated information it became apparent how dreadful the results were for Iraq. I, again wrote a new article analyzing the process, the legal questions regarding IOCs qualifications, the lack of competition, the outcome of the bidding, among others.

Similar to previous article I disseminated a new article highlighting how disadvantageous the outcomes are for Iraq and, thus, called for immediate and complete rejection of the bid round (جولة التراخيص الاخيرة: نتائجها سيئة جدا ويجب الغائها فورا http://www.akhbaar.org/home/2018/4/243448.html posted on 27 April 2018).

The Ministry was compelled to post the two model contracts two days after convening the bid round; and there was a further shock!

After reading the DPC model I wrote and communicated a third article specifying the main flaws of the contract, its poor text, shaky premises, wrong price equation and how it favors IOCs against Iraqi interests; it was posted on 4 May and also in Arabic (عاجل للغاية- عقود جولة التراخيص الاخيرة اسوء من نتائجها http://www.akhbaar.org/home/2018/5/243755.html posted on 4 May 2018)

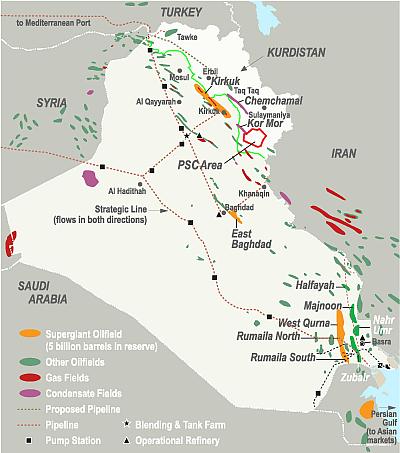

In this last article I reiterated the call to cancel the bid round not only for its disadvantageous results but also due to extremely bad contract models. Moreover, I called the Cabinet to refute the contract for East Baghdad oilfield recently concluded with a Chinese company because this contract has similar structure to those used for this bid round.

The last two articles led to another, but more heated, exchange of emails between Al-Ameedi and I within the same list of high government officials. In this debate I requested a launching of formal investigation to be done collectively by the Independent Integrity Commission, the Parliamentary Integrity Committee, the Inspector General at the Ministry of Oil and the Federal Supreme Board of Audit. The debate was interrupted by the national election and hopefully would be resumed regardless of the election results!!!

Below is the full Arabic text of the unified position by the 31 Iraqi oil experts above mentioned and was posted on http://www.akhbaar.org/home/2018/5/243940.html

خبراء النفط في العراق يعارضون ويرفضون نتائج وعقود جولة التراخيص الاخيرة

السيد رئيس الجمهورية المحترم

السادة رئيس وأعضاء مجلس الوزراء المحترمون

السيدات والسادة رئيس وأعضاء البرلمان العراقي المحترمون

السيدات والسادة المستخدمون لوسائل الاعلام والتواصل الاجتماعي المحترمون

نحن خبراء النفط العراقيين المذكورة اسماءنا ادناه، وبعد الاطلاع على نتائج جولة التراخيص النفطية الاخيرة (الخامسة) وتحليل العقود الخاصة بها، وحرصا منا على المصلحة الوطنية وللتاريخ نعلن بكل وضوح وقناعة:

معارضتنا التامة ورفضنا المطلق لكل من نتائج وعقود هذه الجولة؛ ونناشد كل من مجلس الوزراء والبرلمان على عدم المصادقة على أي من عقود هذه الجولة وعلى العقد الخاص بحقل شرق بغداد.

بعد التقييم المهني والموضوعي للعقود المذكورة والتصريحات المنشورة لمسؤولي وزارة النفط كانت نتيجة التقييم سلبية للغاية لان تلك العقود تمنح امتيازات مالية سخية للشركات النفطية الاجنبية بالضد من مصلحة العراق مما يكلف العراق مليارات من الدولارات كتنازل من عوائده الصافية للشركات.

تتلخص هذه الامتيازات السخية المتنازل عنها للشركات الاجنبية بما يلي:

أ- اعتماد اسعار نفط منخفضة في معادلة سعرية مبسطة جدا وبدائية وغير رصينة تستخدم لاحتساب حصة الشركات من العوائد الصافية لعقود تتراوح مددها بين 20 عام و34 عام؛

ب- اعتماد اسعار مرتفعة للغاز الجاف؛

ج- الغاء آلية ربط ربحية الشركات مع نفقاتها الرسمالية المسترجعة (المعروفة بمعامل آر)؛

د- اعتماد آلية لربط استرداد الكلف الرأسمالية بأسعار النفط لا توفر مطلقا أية حماية او منفعة للعراق؛

ه- عدم تحديد العديد من المتغيرات المهمة لكل حقل وتركها للشركات (مثل انتاج الذروة ومدته؛ الانتاج التجاري؛ تخصيصات صندوق التدريب؛ تخصيصات صندوق البنى التحتية)؛

و- معاملة الحقول المكتشفة على انها رقع استكشافية مما يسبب تجاهلا لحقيقة إنعدام وجود المخاطر التي تتصف بها عادة الرقع الاستكشافية وليس الحقول المكتشفة.

يتلخص هذا التقييم ونتائجه بما يلي:

اولا: يوجد في العقد عدد “هائل” من الاخطاء المطبعية ربما نتيجة للاستعجال في عقد الجولة قبل الانتخابات. كما وتمت الاشارة الى بعض المفاهيم والمصطلحات المهمة والمعرفة ولكن دون استخدامها مثل “معدل المردود الداخلي” و “اعلان الاكتشاف التجاري”.

ولابد من التأكيد هنا ان من اهم اساسيات العقود، وخاصة ان كانت باللغة الإنكليزية، هو دقة النص ووضوح التعبير وسلامة الصياغة؛ وهذه جميعا تتأثر سلبا وبشكل كبير في حالة وجود وتكرار عدد كبير من الاخطاء وعدم تعريف ما يذكر من مفاهيم، مما يؤدي في النتيجة الى ان يكون العقد سيء من حيث التطبيق وخطر من ناحية النتائج ومكلف للغاية في حالة التحكيم الدولي.

ثانيا: عدم وجود الشريك الحكومي

لم يتضمن هذا العقد الشريك الحكومي مما يعني خسارة في حصة العراق تتراوح بين 5 % (بسبب تخفيض حصة الشريك الحكومي في بعض عقود الجولات السابقة) الى 25 % من “العوائد الصافية”. وهذه تشكل خسائر مالية ضخمة جدا للعراق وعائداً اضافياً للشركات. وهنا لابد من التأكيد ان خسارة حصة الشريك الحكومي لا تعوضها حصة الريع Royalty البالغة 25% لان الموضوعين منفصلين تماما.

ثالثا: انعدام التخصيصات السنوية لصندوق التدريب والتأهيل وصندوق البنى التحتية

تمت الاشارة الى كل من الصندوقين في هذا العقد ولكن بدون تحديد التخصيصات السنوية لكل منهما، بخلاف ما كان معمول به في الجولات السابقة.

رابعا: عدم تحديد مستوى انتاج الذروة ومدته Plateau Production & Period

على خلاف كل العقود لجولات التراخيص السابقة لم يحدد عقد هذه الجولة مستوى انتاج الذروة ومدة استمراريته، بل ترك ذلك لحين تقديم الشركة لخطة التطوير النهائية التي تقدم بعد ثلاث سنوات من دخول العقد حيز التنفيذ.

خامسا: مستوى الانتاج التجاري Commercial Production Rate

يحدد هذا المستوى بداية احتساب مستحقات الشركة من العوائد الصافية وحسب الضوابط المفصلة في العقد. ولكن الغريب انه تم تحديد هذا المستوى وبشكل موحد لكل الحقول المشمولة وبكمية 10 ألف برميل يوميا لكل عقد. ومن الجدير بالذكر ان خمسة من “العقود” من مجموع ستة تمت احالتها، تحتوي على تسعة حقول مكتشفة وقسم منها تم فيها حفر خمسة ابار وبنتائج مشجعة جدا.

سادسا: تسعيرة الغاز الجاف

حدد العقد سعر الغاز الجاف بما يعدل 50 % من سعر نفط التصدير التمهيدي (للبرميل المكافئ).

ونرى ان الوزارة هنا ارتكبت أكثر من خطا ستترتب عليها نتائج مالية كبيرة لصالح الشركات الاجنبية ونتائج كارثية على العراق للأسباب التالية:

1- ان هذه العلاقة بين سعر النفط وسعر الغاز الجاف سبق وان تم استخدامها في عقود جولة التراخيص الرابعة فقط؛ لان تلك الجولة كانت للرقع الاستكشافية فقط ولم يتم استخدامها مطلقا لعقود الحقول المكتشفة كما هي عليه الحال في العقود الحالية. وقد سبق لبعض من الموقعين على هذه الوثيقة ان حذروا ونبهوا الوزارة الى ذلك وعدم إطلاق تسمية “رقع استكشافية” على حقول مكتشفة لسبب جوهري يتعلق باعتبارات مخاطر عدم الاكتشاف وضرورة تغطية هكذا مخاطر.

2- كانت “اجور/مكافئة الخدمة او ربحية الشركة” في جميع عقود الجولة الرابعة (كغيرها من عقود الجولات الثلاث السابقة لها) محددة بعدد ثابت من الدولارات لبرميل النفط (المكافئ)؛ اما في هذه الجولة الخامسة فان ربحية الشركة تكون على اساس “صافي العوائد” كما سيناقش لاحقا. والفرق كبير جدا ولصالح الشركة الاجنبية وخاصة عند ارتفاع اسعار النفط.

3- تضمنت جميع عقود الجولة الرابعة (كغيرها من عقود الجولات الثلاث السابقة لها) ما يسمى بمعمل-آر R-factor والذي تنخفض بموجبه ربحية الشركة بتزايد عوائدها على نفقاتها. وتطبيق هذا المعامل من الناحية الفعلية يعني تزايد حصة العراق بعد بلوغ الانتاج مستوى الذروة المتعاقد عليها في الحقل المعني. ولم نجد اي اشارة الى معامل-آر في عقود هذه الجولة مما يعني خسائر مالية كبيرة للغاية يتحملها العراق وتذهب لصالح الشركات الاجنبية.

سابعا: معادلة تحديد “العائد الصافي” وحصة الشركة الاجنبية منه

وهذه تعتبر من أكبر اخطاء الوزارة واكثرها خدمة للشركات الاجنبية واضرارا بمصلحة العراق. وبسبب خطورة هذه المعادلة وافتقارها لأبسط الاسس المهنية والاقتصادية والاحصائية، سنقوم ببيان اخطاء الوزارة وكما يلي:

معدل اسعار النفط العراقي

اعتمدت الوزارة سعر 50 دولار للبرميل “كأساس لسعر النفط” وذلك باعتماد “معدل برنت خلال السنة الماضية وكان بحدود 57 الى 58 دولار مطروح منه 7 دولار”.

اننا نرى ان هذا الرقم وهذه الطريقة تمثل اخطاء فادحة لا تغتفر:

1- ان مدة هذه العقود تتراوح بين 20 و25 عام بالنسبة لعقود التطوير والانتاج و34 عام بالنسبة لعقود الاستكشاف والتطوير والانتاج. فهل من المنطقي اعتماد معدل سعر النفط لسنة واحدة فقط اساسا لهذه العقود طويلة الامد؟ بالتأكيد ليس منطقيا ولم نقرأ او نسمع مطلقا مثل هذه الطريقة لعقود نفطية تبلغ عوائدها عشرات ان لم يكن مئات المليارات!!!!

2- تشير المعلومات الرسمية للوزارة ذاتها ان معدل سعر تصدير النفط العراقي منذ تموز 2008 ولغاية نيسان 2018 (اي خلال 118 شهر) كان 74 دولار للبرميل؛ اي 48 % اعلى من السعر المعتمد من قبل الوزارة!!! فلماذا اهملت هذه الاحصائيات الرسمية ولم يسترشد بها؟؟

3- خلال الفترة اعلاه كان سعر النفط العراقي اقل من 50 دولار في 34 شهرا فقط من مجموع 118 شهر؛ 6 أشهر من تشرين ثاني 2008 والى نيسان 2009، 3 أشهر من كانون ثاني الى اذار 2015 و25 شهرا من آب 2015 الى آب 2017. وهذا يعني ان 28.8% فقط من مجموع الاشهر منذ تموز 2008 كانت اسعار النفط فيها اقل من 50 دولار. فلماذا لم تنتبه الوزارة الى هذه المسالة ولم تستفد منها!!؟؟؟

4- من اوليات علم الاحصاء والتحليل الاقتصادي وممارسات التقييس Indexation ان يتم اختيار سعر او سنة “الاساس” بعناية فائقة جدا وبعد اجراء اختبارات عديدة ولابد من تجنب الفترات الغير اعتيادية. وكان عام 2017 غير اعتيادي بدليل اتفاق الاوبك الذي وضع حدا لانهيار اسعار النفط التي بدأت بالتحسن منذ منتصف العام. فلماذا تم تجاهل هذه الأساسيات العلمية المعروفة!!؟؟

5- يبدو ان الوزارة لم تقم باستشارة سومو وهي الجهة الوحيدة المؤهلة، فنيا، لإعطاء راي بشأن اسعار النفط ضمن تشكيلات الوزارة؟؟ فلماذا تفردت دائرة العقود بتبني سعر للنفط وبهذه الطريقة البدائية للغاية!!؟؟

6- معظم التوقعات الخاصة بأسعار النفط التي قامت وتقوم بها المؤسسات الدولية المرموقة تشير الى ارتفاع اسعار النفط من الان فصاعدا وبالتأكيد فوق مستوى 50 دولار للبرميل سواء في المديات القصيرة او المتوسطة او البعيدة. فمعدل سعر النفط العراقي خلال الاربعة أشهر الاخيرة من هذا العام كان 61.85 دولار- اي 23.7 % فوق سعر الأساس المستخدم في عقد جولة التراخيص!!

يستنتج مما تقدم ان تبني سعر 50 دولار كأساس في احتساب حصة الشركة الاجنبية من “العائد الصافي” يعمل بالتأكيد على زيادة تلك الحصة طرديا بارتفاع اسعار النفط فوق سعر الاساس المنخفض اصلا. والحسابات اعلاه تشير ان الشركات حققت زيادة قدرها 23.7 % في حصصها من “العائد الصافي” حتى قبل توقيع العقد.

ربط استرداد الكلف الرأسمالية بأسعار النفط

يشير العقد الى ان “نسبة العائد الصافي” المخصصة لاسترداد الكلفة تكون 30 % عندما تكون اسعار النفط تساوي او اقل من 21.5 دولار وبعكسه تكون النسبة 70%.

وهنا نسجل الملاحظات التالية:

1- لم تذكر الوزارة كيف تم تحديد هذا السعر؟ ومن قبل من؟ وماهي الحسابات والمبررات التي استند عليها؟

2- لم تشهد اسعار تصدير نفط العراق مطلقا هذا السعر المنخفض منذ تموز 2008 ولحد الان. وان أوطأ سعر كان 22.21 دولار ولشهر واحد فقط وهو كانون ثاني 2016. فما هي الحكمة والفائدة من تحديد هذا السعر المنخفض ليكون اساساً لتجنب أثر تسديد الكلف الرأسمالية!!!

3- ونظرا لضعف احتمالية انخفاض اسعار النفط العراقي الى ذلك المستوى ولمدة مؤثرة فان ذكر هذا الشرط في العقد لا يشكل اي فائدة للعراق ولا يوفر من الناحية العملية والفعلية اي حماية؛ وبالمقابل اعطى العقد نسبة 70% للشركة لاسترداد الكلفة.!!

4- والاخطر من كل ذلك ان العقد لم يحدد بوضوح ماذا يحصل لنسبة العائد الصافي عند استرداد الكلف الرأسمالية بالكامل خاصة وان العقد لا يتضمن معامل-آر كما ذكر سابقا.

يستخلص مما تقدم ان ربط استرداد الكلفة بأسعار النفط وبالصيغة المعتمدة بالعقد تخدم الشركات الاجنبية وبالضد من مصلحة العراق.

ثامنا: التعارض مع الدستور وقوانين الموازنة وسياسة الدولة المعلنة

من الاسس الدستورية المهمة في ادارة القطاع النفطي هو “تحقيق اعلى منفعة للشعب العراقي” (المادة 112 –ثانيا)؛ كما اكدت قوانين الموازنة (منذ 2015) على ” حفظ مصلحة العراق الاقتصادية ….. وتخفيض النفقات وايجاد الية لاسترداد التكاليف بحيث تتلاءم مع اسعار النفط”.

فاين هي مصلحة العراق وكيف تم تحقيق اعلى منفعة للشعب العراقي في عقود هذه الجولة وعقد شرق بغداد؟ وهل اعتماد اسعار النفط المذكورة في العقد- كما ذكر اعلاه- تحفظ مصلحة العراق الاقتصادية؟؟؟

لقد تمت احالة ثلاث من ست “رقع” الى شركة مدرجة في القائمة السوداء لمخالفتها-ومازالت- سياسة الدولة المعلنة منذ 2010. وإننا نحذر وبكل قوة ان التعامل مع شركة مدرجة في القائمة السوداء سيترتب عليه نتائج قانونية سيئة للغاية وعلى المستوى الدولي على قدر تعلق الامر بسيادة العراق على ثرواته النفطية والغازية وخاصة فيما يتعلق بعقود الاقليم وقضية التحكيم الدولي ضد تركيا امام غرفة التجارة الدولية في باريس.

في ضوء ما تقدم فإننا نناشد كل من مجلس الوزراء والبرلمان على عدم المصادقة على أي من العقود الخاصة بهذه الجولة وعلى العقد الخاص بحقل شرق بغداد.

الموقعون

1-طارق شفيق؛ 2-عصام عبدالرحيم الجلبي؛ 3-عبد الجبار الوكاع؛ 4-د. هاشم الخرسان؛ 5-د. طارق الارحيم؛ 6-د. محمد علي زيني؛ 7-فؤاد قاسم الامير؛ 8-د. طلال عاشور كنعان؛ 9-د. ثامر حميد العكيلي؛ 10-د. موفق اديب الصمدي؛ 11-منير الجلبي؛ 12-د. اسامه فرحان عبد الكريم ؛ 13-د. محبوب الجلبي؛ 14-عبدالزهرة جودة كاظم المحمداوي؛ 15-سمير كبة؛ 16-عبد يوسف بولص اسمرو؛ 17-ناطق خضر عباس البياتي؛ 18-د. فالح حسن الخياط؛ 19 -علي حسين عجام؛ 20-نوري العاني؛ 21-ضياء إبراهيم الحسن؛ 22-سعد الله الفتحي؛ 23 -فلاح كاظم الخواجة؛ 24-محمد مصطفى الجبوري؛ 25-علي عبد الباقي الحيدري؛ 26-علي نوري علي الصالح؛ 27- ضياء شمخي البكاء؛ 28 -دـ حسن علي الناجي؛ 29 – د. نبيل توحلة؛ 30- احمد موسى جياد (منسق هذا الموقف الموحد) .

يرجى تعميمه ونشره على اوسع نطاق ممكن

مع فائق التقدير والاحترام

احمد موسى جياد

(منسق الموقف الموحد لخبراء النفط العراقيين)

استشارية التنمية والابحاث/ العراق

النرويج

8 أيار 2018

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.