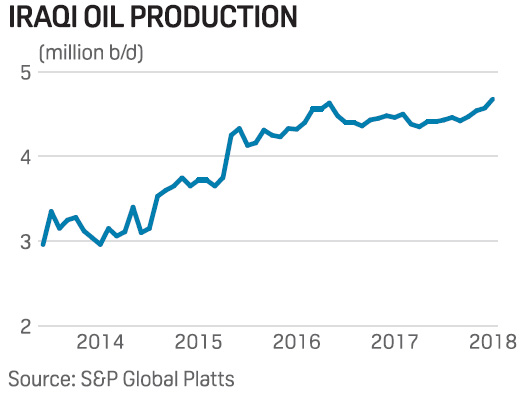

DNO ASA, the Norwegian oil and gas operator, today announced production at the Peshkabir field in the Kurdistan region of Iraq has ramped up to 50,000 barrels of oil per day (bopd), meeting the end-2018 target ahead of schedule and below budget.

One of two recently completed wells, Peshkabir-7, is producing over 10,000 bopd from nine Cretaceous zones through temporary test facilities and exported. The other, Peshkabir-6, drilled as a production well, but with the additional objective of appraising deeper formations, has established a deeper Cretaceous oil/water contact level than previously estimated. Further testing is underway, including test production of multiple producing zones.

The Peshkabir-8 well, spud in late August, is drilling ahead at 2,325 meters. Once completed, the rig will move to spud Peshkabir-9 in November.

Four other wells at Peshkabir now produce at a combined rate of close to 40,000 bopd following a workover at Peshkabir-3 which boosted production from that well to 11,000 bopd from 8,000 bopd.

Peshkabir production is processed through temporary test facilities until commissioning of a central processing facility with a capacity of up to 50,000 bopd by end-2018. The Company is also installing a 10-inch pipeline from Peshkabir to Fish Khabur with a capacity of 60,000 bopd. Field production is currently transported to Fish Khabur by tanker truck and a 6-inch pipeline.

At the Company’s flagship Tawke field, the Tawke-50 shallow Jeribe well drilled to a depth of 320 meters will be brought on production within several days. The Tawke-49 Cretaceous well is drilling ahead at 2,245 meters and will be completed later this month. Two additional Tawke wells, one each in the Jeribe and the Cretaceous, will be drilled by the end of the year. Workovers are also underway at two wells. Tawke production currently stands at just over 80,000 bopd.

Elsewhere in Kurdistan, the Company is about to spud its first well at the Baeshiqa license. Baeshiqa contains two undrilled structures with multiple target reservoirs in the Cretaceous, Jurassic and Triassic. The first well will target the Cretaceous and will be followed by a back-to-back well to test the deeper Jurassic and Triassic on the same structure. A third well to test the Jurassic and Triassic on a separate structure will be drilled in 2019.

“We are all in on our Kurdistan operations and delivering,” said DNO’s Executive Chairman Bijan Mossavar-Rahmani (pictured). “Peshkabir continues to exceed expectations and we are eager to probe the promising potential at Baeshiqa,” he added.

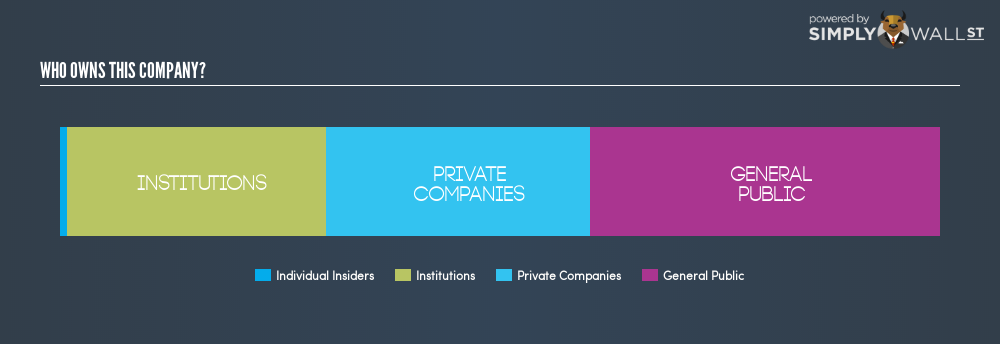

In Norway, the Company will participate in two exploration wells to be spud in 2018. DNO currently holds 21 licenses in the country and plans an additional five exploration wells next year. The Company’s growing Norway portfolio is complemented by a 28.22 percent shareholding in UK-listed Faroe Petroleum plc.

“With USD 1 billion in financial assets, including more than USD 600 million in cash and the balance in marketable securities and treasury shares, we are well-positioned to grow our footprint in Kurdistan and Norway with the drill bit and the acquisition of producing assets,” said Mr. Mossavar-Rahmani.

(Source: DNO)