By Ahmed Mousa Jiyad.

Any opinions expressed are those of the authors, and do not necessarily reflect the views of Iraq Business News.

IEITI: Making Iraq “Compliant” Again!

The Extractive Industries Transparency Initiative (EITI) suspended Iraq’s status as a “compliant” country on October 2017; the suspension, after initial irrational denial, prompted the Iraqi authorities to take necessary measures addressing this matter aiming for reinstating the country’s status and restoring relations with EITI.

The delayed, and still disappointing, 2016 IEITI Annual Report and this workshop, on the Report, are part of the formal efforts for making Iraq compliant again.

I have been following the progression of IEITI since its inception and directly involved, as independent external consultant, in many related research-work, peer-review assessments of related research papers, capacity development activities and consulting assignments, particularly those through Revenue Watch Institute-RWI (USA) and later through Natural Resource Governance Institute-NRGI (UK/USA).

Moreover, I have assessed every IEITI Annual Report since the first one on 2009 in addition to other related documents, work plans, annual activity reports and reports among others; as the two annexes to this intervention testify.

This brief is an outline of the PowerPoint presentation prepared, after formal invitation from IEITI National Coordinator, for and to be delivered, through Skype, before “Energy Experts Workshop on IEITI 2016 Annual Report” held in Baghdad, Iraq, 2 February 2019.

Key Messages

- «Good Reporting» on Transparency improves transparency and enhances good governance;

- “Publishing reports is not a goal in itself”;

- IEITI annual Report is sovereign obligation and thus should be depoliticized;

- 2016 Report: Progressing but Gaps Persist and the Disappointment Continues

- Future IEITI annual Reports ought to be more qualitatively different from previous ones;

- National capacity involvement in the process of IEITI Annual Reports preparation SHOULD be substantive and progresses significantly;

- IEITI should be more “Independent” and Impacting than

Main Topics for Debate and Discussion

I – The Essence of Transparency in the Iraqi Extractive Industry (……..);

II – Assessing IEITI Annual Reports from 2009 through to 2016: Methodology & Guiding Principles; Each of these assessments was guided by and upholds four basic principles to be:

- Objective (Pros & Cons: for & against)

- Credible (Factual, truthful and evidence-based; cites examples, provides reference, specifies the case or the subject matter,.., ),

- Independent (Professional, industry-focused, analytical and inquisitive)

- Constructive (Improvement-oriented, forward-looking: provides suggestions, recommendations and way-out; what, how and why..)

III – IEITI 2016 Report: The Gaps Persist, the Disappointment Continues!?

PROS: Progressing but not there yet; it keeps the record of produced annual reports; First since Suspension; Includes 25 “Requirement-guided” contents.

CONS: Too long; Old information; Structurally fractured; Too many methodological flaws; Unforgivable statistical errors; Many inconsistencies; Missing items; Lacks comparative assessment; Irrelevant for policy implications; Astonishing “double counting” misjudgment; Unconvincing higher “materiality threshold”; Wrong understanding of basic terms; Lacks explanation of very apparent and substantive data irregularities; Nothing on what plagued the sector: e.g., corruption!; Missing reconciliations of important data/revenue; Unexplained unreasonable huge PP price differentials; “Not intended to be relied upon” for “professional advice”!!!!!!; Too many more!!!!!

Required Immediate Actions for IEITI Report 2016

- Remove the IEITI Report 2016 immediately from IEITI website;

- IEITI-NS & EY Revise, Correct, Redraft and significantly Shorten the Report to make it readable and understood by non-specialists;

- Cross-check (verify) the Report by External Independent Consultant;

- MSG reviews and approves the cross-checked Report;

- Circulate the cross-checked shortened, reviewed redrafted version and then translate it into the three languages.

- Organize few activities for specialized and professional debating of the report first then embark on wider societal engagement through different forms of participatory modalities.

IV – Lessons Learned: What, Why, How

Instead of repeating, through the usual copy& paste, lessons learned in almost every annual report, a detailed assessment of lessons learned over the 10 year experience and suggestions are done on the following related and relevant four blocks.

First, Report contracting and preparation process (……..) ;

Second, MSG’ role, effectiveness and openness (……..);

Third, IEITI- NS (…….);

Fourth, the Reconciler/ Administrator (…….).

V – IEITI Way Forward– from Symbolism through Effectiveness to Impacts

A. Specific “Monthly/Quarterly/Annual” Evidence-Based & Verifiable Transparency Indicators (what, where, how, why..):

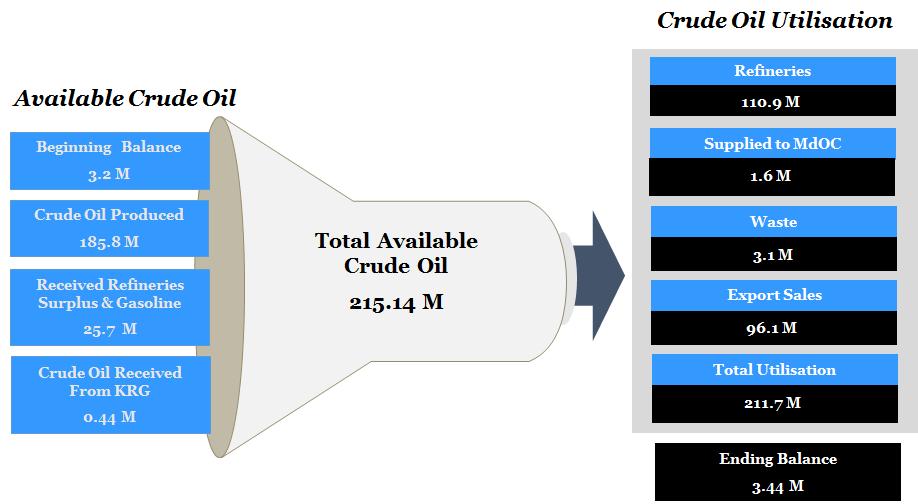

SOMO (volume, value, Crude type & export outlets; destination & who bought bow much, etc ;

PCLD (Field based IOCs investment; Cost recover & RF in cash and in kind; Contracts disclosure; Production ; Employment & Training; CSR; etc;

NOCs “Material balances” for BoC, MoC, MdoC, TQOC, NOC;

NGC & SGC

NRCs Input-output (CO:PP) balances: NRC, MRC, SRF;

Other MoO’ SOEs & related entities, …etc.;

MoE (Power generation)

GCT (CIT)

B. Undertake realistic and factual IEITI SCOR Analysis;

C. Identify Capacity & Skill Gaps;

D. Focus on how to making and keeping Iraq EITI “Compliant”;

E. National Capacity Development Action & Priority Plans;

F. IEITI Structural Model & Report Process;

G. Make IEITI “really transparent and truly open”; it is logical inconsistency and counterproductive that a transparency agency is non-transparent!!!

H. The Reconciler/ Administrator of the IEITI Annual Report (contractual condition);

VI – Concluding Remarks and Key Takeaways

Iraqi EI governance is complex, politicized, challenging but very significant case in MENA region.

Key Takeaway: Addressing IEITI short term capacity gaps and challenges could help attaining the long term aspirations.

Improvement of IEITI working process should have a priority in bridging the Capacity Gap aiming for Real, Comprehensive, Good, Democratic and Effective EI Governance. Key Takeaway: Good, Thorough and Timely Reporting on Governance Improves Governance

Future IEITI Reports become more detailed, comprehensive and challenging due to:

1- Addressing the flaws of previous Reports and learns from past experience are a must;

2- The EITI Standard is progressing and thus its related requirements;

3- The governing contractual modalities and conditions in the Iraqi extractive industry, especially in the petroleum sector.

Key Takeaway: National Capacity Development Activities and Specialized Human Resources within IEITI-NS are urgently needed and doable;

EITI “Compliance” is always conditional and thus must be maintained.

Key Takeaway: There is no “business as usual” or “complacency” or “mission accomplished”

IEITI needs to be more “Independent” and “Proactive”.

Key Takeaway: Avoid “appeasement” of wrong-doing;

Don’t be “mute” on obvious non-transparent official practices;

Be aware of the deceptive praise by “Sultans’ advisers” and alike!!

Annexes

A1- List of Research and Publications by IDC&R on IEITI and Transparency Issues.

A2- List of Presentations, Capacity Development and Consultancy Services by IDC&R, particularly those done for IEITI, RWI/NRGI.

Annexes are available upon request from Iraq/ Development Consultancy & Research-IDC&R.

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.