By Ahmed Mousa Jiyad, Iraq/ Development Consultancy & Research, Guest Editor IJCIS-SI, Email: mou-jiya(at)online.no.

2018 is, in more than one aspect, rather an important year; It commemorates the 60 anniversary of 14 July revolution 1958; it registers thirty years of ending the eight years long Iran-Iraq war; it counts fifteen years of the country’ invasion by the Anglo-American lead troops; it also marks a ten year period of grand opening of the petroleum sector to foreign companies; it witnessed the almost end of the “triple shocks” that paralyzed the country and finally, it testifies a minor change of the dysfunctional democracy and plaguing Kleptocracy.

This is the “Introduction” I wrote, as the Guest Editor, for the special issue of the academic International Journal of Contemporary Iraqi Studies-IJCIS, due for release before year ends (by Intellect Books, UK)*

14 July 1958 revolution is still vivid in the memories of many of us who actually witnessed and lived that day and what followed to date. Much has been written about July Revolution during the six decades since that day, but for 2018 two important observations worth making.

First, despite a relatively short tenure of General Abd al-Karim Qasim government (14 July 1958 to 8 February 1963) its record of social economic and development achievements were not matched by achievements of all regimes since Qasim’ assassination, particularly those of post 2003. An article published on the local akhabaar news-site[1] lists most of Qasim achievements, which should make every post 2003 politician, decision maker, parliamentarian, minister among others feel ashamed.

Second, Iraq witnessed during July this year a popular mobilizations in all southern oil producing provinces protesting against lack of employment, deteriorated standard of living, insufficient basic social services especially electricity and safe drinking water and condemning the corruption in the country. In a way, July-September 2018 popular protest vindicates July 1958 revolution achievements comparative to the apparent failures of all post 2003 governments.

Thirty years ago Iran-Iraq war ended; a war that caused too much death, devastation, sufferings and pushed Iraq on the brinks of degeneration; further wars and sever comprehensive sanction led eventually to invading the country.

American and British troops invaded the country in 2003, toppled Sadam régime and, again, brought too much death and destruction but with dismantling most state institutions, inflict serious blows to social fabric and institutionalized sectarianism and ethnicity. Over these 15 years, much of oil export revenues were the target of an unprecedented cronyism and corruption, mostly Kleptocracy (defined here as formalized corruption by formal entities and influential political groups and oligarchy) with meager, if any, of actual economic and social development as manifested by spreading July 2018 demonstrations that left many dead, injured and good number of arrests.[2]

The security situation in Basra deteriorated dramatically on 4 September when the number of killed demonstrators rose to 9 with many more injured on both sides i.e. the demonstrators and security forces, and a number of local government building set on fire.[3] By 7 September number of fatalities in Basra increased to 15 dead and 190 injured with more building including private, foreign consulate and offices of some political parties put ablaze.[4]

Post 2003 democracy was basically confined to national and provincial elections, which were run on regular intervals, but none was without accusations, irregularities and corruption practices. National election of May 2018 has been the most challenged and precarious among them all. Election results were not approved until three months after the election day even with recounts and involvement of High Judicial Council and the Federal Supreme Court-FSC; the term of the parliament ended on 30 June and the new parliament remains in limbo and was not convened and thus nominating the heads of the presidencies was delayed and the same applies to forming the new government.

FSC approved the recounted results on 19 August 2018 indicating the start of the constitutional process for forming the new government. The new parliament was finally convened, amid rather a different and also divisive political landscape post 2003, on 3 September. Not until 16 September the election of the president of the parliament was elected and on 2 October Dr. Barham Salih was elected the president of the republic- representing serious setback for Barzani’s party- and on the same day Salih asked Adil Abdul Mahdi, a pro privatization, the Kurds and IOCs, to form the government within 30 days!

Provincial elections are scheduled for year ends unless they are impacted by the negative environment that tarnished the latest recent national election; the current political confused order would suggest strongly the likelihood of postponing the provincial election to further date. But these too were and could be subject to even more irregularities with influential forms within sectarianism, tribalism and religious personality cult. Moreover, the aftermath of July demonstrations could effectively impacts holding, the process and the outcome of the elections.

The local parliamentary election in Kurdistan Region in Iraq was held over 28-30 September and again with different contested claims on its transparency, credibility and results.

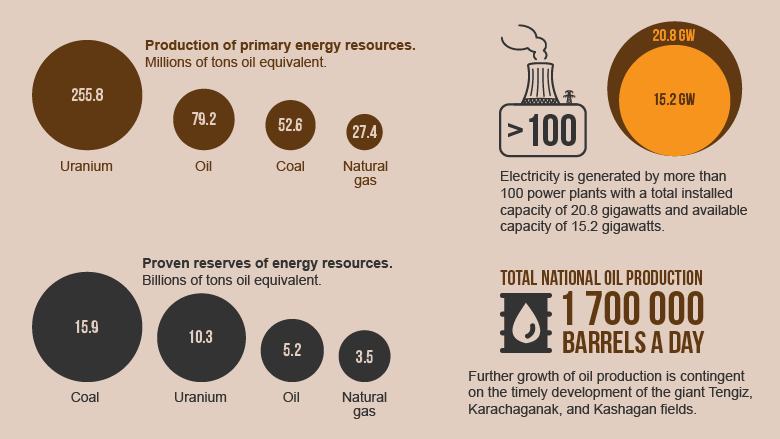

2018 marks ten years of the big-push strategy or grand opening of the upstream petroleum for foreign investment and direct involvement that validates, initially, the school of thoughts that invasion was all about oil but the actual development questions that validation. The big-push strategy began by converting a production sharing agreement, was concluded during Sadam’ era when Iraq was under the severest sanction in history, into a long term service contract.

That conversion sets the main premises of a hybrid model contract that was adopted through four major bidding rounds. However, upstream petroleum since the cabinet shift of August 2016 witnessed a departure from previous practices by the return of deals concluded behind closed doors, lack of transparency and adoption of a net revenues sharing model contract that gives IOCs much more a share than offered under the previous four bid rounds.

2018 witnessed the beginning of the end of the triple-shocks i.e., low oil prices, Da’esh presence and retaking Kirkuk back from KRG seizure.

Da’esh (or ISIS/ISL) began by controlling Mosul in mid-2014 then moved to many parts of other governorates particularly Kirkuk, Salahuldeen, Dayala, Al-Anbar and came close to Baghdad. That caused untold destruction, killing, internal displacement and threatened the security and integrity of the country. The military operations to defeat Da’esh drained serious part of the annual state budgets in addition to officially estimated $100 billion reconstruction requirements.[5]

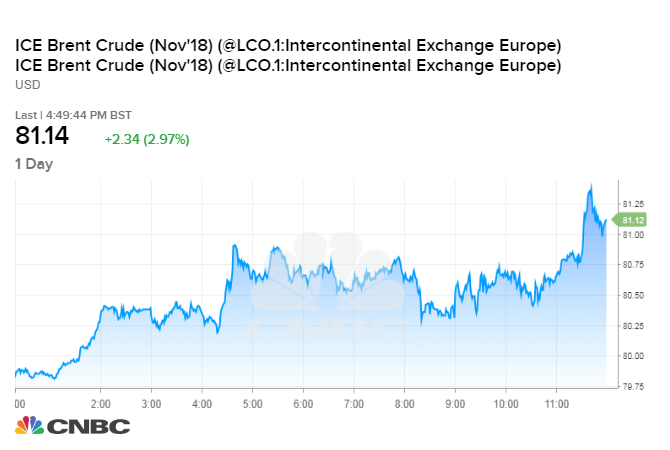

What made the situation even more alarming and drastic are the dramatic decline in oil prices and the prevailed motion of “lower for longer” that coincided with Da’esh attacks. Iraq oil export prices per barrel declined from $102.61 in June 2014 to $22.21 in January 2016 then improved gradually to exceed $74 during September 2018.

Further deterioration in Iraq financial situation was caused by the cessation of Kirkuk oil export when KRG took control of the province’s oil facilities. Though that seizure ended during the fourth quarter of 2017, export from Kirkuk still on hold at the time of writing.

The work on this special issue took eighteen months of concerted efforts, follow-up and back and forth communication involving all editorial colleagues, publisher’s team, anonymous reviewers and contributors. Well-deserved sincere and wholehearted words of thanks and appreciation are due to all of them.

Ahmed Mousa Jiyad provides review of the development of the Iraqi petroleum sector during the period 2008-2018 as post 2003 period witnessed grand opening of the sector for International Oil Companies- IOCs, particularly for upstream sub-sector. The article argues that, analytically and empirically, a sub-sector focused policy impacts, negatively, the development in that sub-sector, in the sector itself and on the sector’s contribution to the development of the national economy. The outcomes would exacerbate structural imbalances, vulnerabilities to external factors and increase dependency on oil revenues, which prohibits desirable structural change, diversification and transformation.

He also highlights the presence and impacts of the “triple shocks” combined with the prospect of “lower-for- longer” oil price that prevailed almost a year ago, contributing to continue deepening the fiscal crisis of the state and elevated the “fear-factor” among Iraqi decision makers. That, with apparent human, systemic and institutional capacity-gaps limitations resulted in Iraq giving important concessions to IOCs without having tangible benefits in return.

Juman Kubba asserts that Iraq, over the past fifteen years, took huge leaps backwards. Thus, she argued it is very important for politicians, historians, experts and judicial bodies to analyse what happened, why it happened, who is responsible and how to hold them accountable. But what is more important now is to ensure that Iraqi society recovers from the calamities of the past fifteen years as well as the preceding thirty years; and that the country’s resources are used to serve Iraqis and provide them with good living conditions and never again be wasted and dissipated. Accordingly, here article focuses on the pathway of healing Iraqi society from the aftermath of decades of war, poverty and immense suffering.

Restoring good education and healthcare is the first step on the pathway of healing and recovery. Also, neutralizing and reversing several dangerous post conflict societal problems that have arisen over the years such as traumatized war children, war injured young men, drug abuse among youth and alarming increase in neoplastic disease just to name a few. Given the weakness of the government, corruption, and contradictions between legislation and jurisdiction, one must consider new non-traditional approaches to solving these problems; a few are presented in the article. The success of any future government should be measured by how much it can ameliorate the essential life sustaining services for ordinary citizens.

Monetary policy and particularly the role of the Central Bank have important function in the development of the country. Debating this issue, our late colleague Muwafaq Hassan Mahmood addresses four topics; the first offers an empirical examination of the performance of the banking sector during the period 2010-2015; the second discusses banking sector reform requirements; The third topic will shed light on: i) the environments under which the Iraqi banking industry operates highlighting the limitations and obstacles that impedes the sector’s growth and ii) the investment environment and whether it’s an attractive for the business community to invest and doing businesses in Iraq. Finally, he examined the CBI’s dollar window impacts on the banking industry.

Human skills, systemic and institutional capacity gaps impact the performance of the petroleum sector and these have been the subject of international cooperation between Iraq and other entities e.g., countries, organizations and even companies. Usama Karim article focuses on one of such initiatives i.e., the establishment of the European Iraqi Energy Centre-EUIEC. He argues that knowledge acquisition and development leading to such endeavour is a process that takes long time and much resources needing meticulous planning. This process can be facilitated by the use of expertise and technology transferred by international companies and their networks engaged in ramping up energy production in Iraq.

EUIEC has four components, however, the article elaborates on the research component but Karim suggests that the final EUIEC organization, structure and facilities integrating all its components will require further efforts from the consultants, lead stakeholders and experts in setting up such complex endeavour building up on preliminary results from this study.[6]

Greg Muttitt article reviews what is now known about discussions of oil that took place during the invasion planning and execution, based on documents that have been released in the fifteen years since.

He examines the nature of the strategic objectives, how the US and UK governments planned to achieve them, and how they decided to talk about them in public. Reflecting on this evidence will allow us to revisit the question: was oil a major reason for the war and invasion of Iraq?

Federalism, an outcome of the regime change brought by the 2003 invasion and was enshrined in 2005 Constitution, needs fixing. Since 2003, Luay al-Khatteeb argues, Iraq’s experiment with federalism has in many ways benefitted Iraq, though, he asserts, functioning federalism was never given a chance to be tested in Iraq as there are various factors that have contributed to hinder the formation of a Federal Iraq. Thus, because implementation has been imperfect, it has not solved Iraq’s fundamental economic flaws, which promote the waste of oil revenues, promote oil revenue dependence and allow for local level corruption to flourish. This situation can still be remedied, he argued, but that requires time and may take generations to materialise.

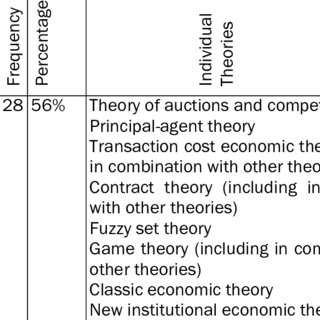

Omar Eljoumayle article summarises his PhD dissertation in economic development of contemporary Iraq. The article traces the role of institutions, institutional policies and how the rapid and frequent institutional changes have driven the Iraqi economy for decades. Though applying the New Institutional Economic-NIE to Iraq expands the range of choices of institutions that could be examined, the choices have been narrowed down by revolving around three central issues: agriculture, oil and wars. The picture painfully presented is one of abrupt and instantaneous institutional changes, through which institutions were repeatedly subject to reshuffle and facing changing circumstances. Consequently these changes have severely affected the path of economic development in Iraq.

The book review part of this volume covers to recently published, in Arabic, important books: one on Iraq’s nuclear program and the other on the Iraqi economy.

While it gives me a great professional scholarly satisfaction to be the guest editor for this issue I regret to report that our colleague and contributor, Muwafaq Hassan Mahmood, passed away on 28 June 2018. Despite his illness and he and I knew he would be not with us for long, Muwafaq (Abu Rand) was very determined and enthusiastic to deliver his article and honors his commitment before leaving us. I have known Abu Rand since mid-sixties and his early departure was indeed a devastating painful loss. My colleagues, Professor Tareq Ismael (Calgary, Canada) and Professor Bill Haddad (California, USA), and I convey our wholehearted condolences to his family, friends and colleagues and we sincerely thank Muwafaq for his contribution to this special issue.

Ahmed Mousa Jiyad,

Guest Editor, IJCIS-SI,

Norway

4 October 2018

*Jiyad, Ahmed Mousa, Introduction, IJCIS, Volume 12, number 3, 2018 (forthcoming)

[1] 1958 revolution the 60th anniversary (Performance of Qasim in akhabaar http://www.akhbaar.org/home/2018/7/246337.html (in Arabic) accessed 14 July 2018

[2] As on 22 July the Iraqi Human Rights Commission announced 13 dead, 729 injured, including 460 from security forces, 757 arrested temporarily and release later and 91 government and private buildings and vehicles were damaged. http://www.akhbaar.org/home/2018/7/246645.html accessed 23 July 2018.

[3] As reported by IOR, 5 September 2018

[4] http://www.akhbaar.org/home/2018/9/248576.html Accessed 8 September 2018

[5] On Da’esh effect, Kuwait conference and cost of reconstruction see , $100 billion for reconstruction http://www.iraq-businessnews.com/2018/02/12/video-iraq-seeks-100bn-for-post-is-reconstruction/

[6] Actually, I was the leader of a team that prepared the “Formulation study for the EU-Iraq Centre for Economic Partnership and Business Cooperation (DCI-ASIA part)”, which was commissioned and funded by the European Commission-EC during the period January-June 2012. The study resulted in formulating and recommends the establishment of EUIEC with four major components: Research, Training, Energy Debate and Business Cooperation. The EC adopted our proposal and started the implementation in 2014 through the Service contract notice “Iraq-Baghdad: ICI+ — EU–Iraq energy centre (EUIEC) 2014/S 074-126988”

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.