By John Lee.

Shares in Gulf Keystone Petroleum (GKP) were trading up more than three percent on Thursday morning after the company proposed issuing $50-million in dividends this year.

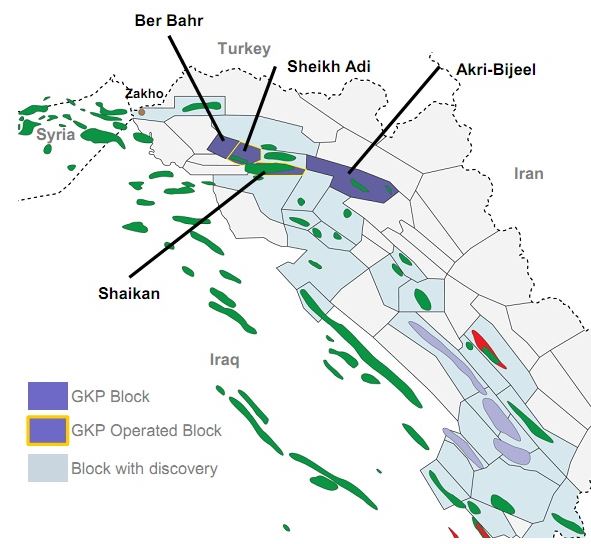

The company, which produces oil at the Shaikan field (pictured) in Iraqi Kurdistan, issued the following statement as part of its 2018 Full Year Results:

Financial

- Record revenue of $250.6 million (FY 2017: $172.4 million)

- EBITDA of $149.3 million (FY 2017: $104.3 million)

- Profit after tax of $79.9 million (FY 2017: $14.1 million)

- Net capital investment in Shaikan of $35.7 million (FY 2017: $8.1 million)

- Cash balance of $295.6 million at year end (2017: $160.5 million)

- The Company anticipates being fully funded for all phases of the Shaikan expansion

programme under its current set of assumptions - $100 million bond refinancing in July 2018

Dividend

- The Board confirms a dividend policy to shareholders, which will comprise an annual dividend on the ordinary shares of the Company of no less than $25 million per financial year

- The Company is therefore pleased to announce its intention to pay an ordinary dividend on the ordinary shares of $25 million in 2019 and, given its current financial strength, the Board is also proposing to complement the ordinary dividend in 2019 with a $25 million supplemental dividend to shareholders on the ordinary shares

- The total dividend of $50 million will be subject to approval at the next AGM in June 2019. One third of the total dividend will be paid following approval at the Company’s AGM, with the balance payable following release of the Company’s half-year results

Operational

- Full year gross average production of 31,563 bopd (2017: 35,298), at the upper end of guidance

- GKP and its partner MOL reached agreement with the MNR in June 2018 to recommence investment into Shaikan, towards an initial production target of 55,000 bopd by Q1 2020

- Common vision for a phased development that will grow gross Shaikan production to 110,000 bopd

- The development vision described by the revised Field Development Plan (“FDP”) was submitted in October 2018. This revision has not been accepted by the MNR, specifically due to a request for additional assurances on the timing and commitment to eliminate gas flaring. As the parties aim to progress this matter and reach an agreement, investment on the ground continues as per the initial phases of this plan

- On target to achieve plant de-bottlenecking by year-end and tie-in of the pipeline from PF-1 to the export system mid-year

- GKP internal review indicates an upgrade in Proven (1P) reserves and no material changes to Probable reserves (2P). A revised Competent Person’s Report to be released following FDP approval

- Robust HSSE performance with one LTI in 2018, the first in three years

Corporate

- Signature of Crude Oil Sales Agreement in January 2018 normalised payments in line with oil prices and production. Renewed in February 2019 through to 2020 providing certainty over payments for the foreseeable future

- Further strengthening of the Board in 2018 with Jaap Huijskes appointed as Non-Executive Chairman, Martin Angle as Senior Independent Non-Executive Director and Kimberley Wood as Non-Executive Director

Outlook

- On track for material uplift in production to 55,000 bopd in Q1 2020

- In 2019, gross Capex associated with 55,000 bopd phase of between $130 million and $150 million, in addition to $20 million to $45 million associated with the subsequent development phase

- Dividend distribution from 2019 onwards

- Gross production guidance for 2019 unchanged at 32,000 – 38,000 bopd

Jón Ferrier, Gulf Keystone’s Chief Executive Officer, said:

“Throughout 2018, our focus was on laying the foundations for the delivery of the Company’s phased growth plans, which envisages a step change in production profile. The Company is on track to achieve its near-term production target of 55,000 bopd in Q1 2020, and with our partner MOL continues to work towards delivering the staged investment programme. The remarkable Shaikan reservoir presents a straightforward, low-cost onshore development opportunity with unrivalled near-term upside.

“The new dividend policy represents another major milestone for the Company. It crystallises returns to shareholders while we preserve the ability to fully fund the Shaikan development and maintain a strong balance sheet; our platform for growth.“

(Sources: GKP, Yahoo!)