Pearl Petroleum Company Limited, the consortium led by Crescent Petroleum and Dana Gas of the UAE, has signed a new 20-year Gas Sales Agreement (GSA) with the Kurdistan Regional Government (KRG) to enable production and sales of an additional 250 MMscf/day that the consortium aims to produce by 2021 as part of their expansion plans in the Kurdistan Region of Iraq (KRI) in order to boost much needed local domestic electricity generation.

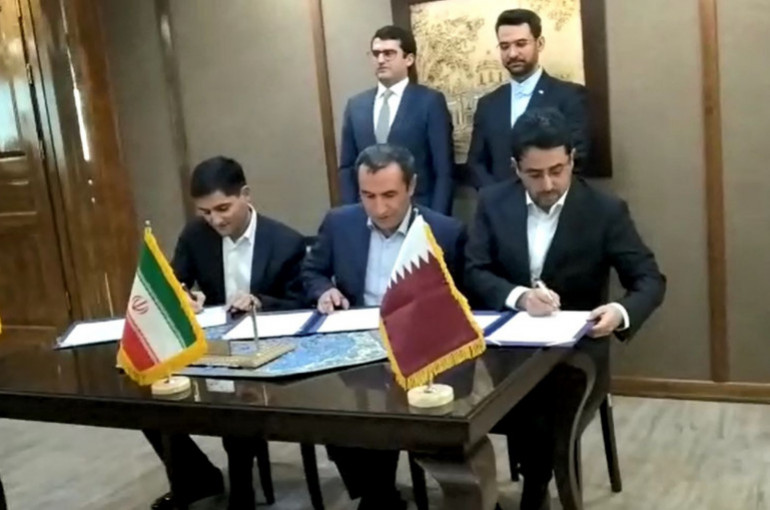

Pursuant to the Settlement Agreement reached between the parties in August 2017, this new gas sales agreement was signed on 19th February 2019 by Dr. Ashti Hawrami, Minister of Natural Resources on behalf of the Kurdistan Regional Government, and Mr. Majid Jafar, CEO of Crescent Petroleum and Board Managing Director of Dana Gas, on behalf of Pearl Petroleum.

All approvals for the agreement, including by the the Kurdistan Region Council for Oil & Gas Affairs and the Board of Pearl Petroleum, have since been granted, with project work now under implementation.

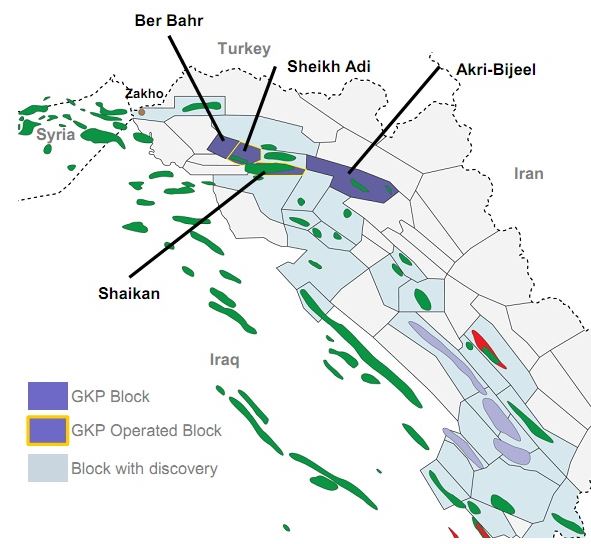

The Kurdistan Gas Project was established in 2007 as Dana Gas and Crescent Petroleum entered into agreement with the Kurdistan Regional Government (KRG) for certain exclusive rights to appraise, develop, produce, market, and sell petroleum from the Khor Mor and Chemchemal fields in the Kurdistan Region of Iraq (KRI).

Production from the newly built plant in Khor Mor began just 15 months later, in October 2008. In 2009, Pearl Petroleum was formed as a consortium with Dana Gas and Crescent Petroleum as shareholders, and with OMV, MOL, and RWE joining the consortium subsequently with a 10% share each.

The $700 million expansion underway at the Khor Mor plant will include the addition of two new production trains at the Khor Mor plant, as well as drilling of new wells with plans to raise production from the current 400 MMscf/day to reach 650 MMscf/day by 2021 based on this latest GSA, and then to 900 MMscf/day beyond that by 2022.

This follows the 30% production increase from debottlenecking throughput at the Khor Mor plant, which brought current total production to 106,000 barrels of oil equivalent per day (boepd), making it the largest regional private sector upstream gas operation in Iraq today.

Gas sales commenced late in 2018 under a gas sales agreement signed in January of that year, and all payments have been received in a timely manner in full, which gives confidence for the investment and expansion plans currently underway by the Consortium. The Kurdistan Gas Project, which recently commemorated 10 years of continuous production, supplies natural gas from the Khor Mor field by pipeline to power plants in Bazian, Chemchemal and Erbil, as well as LPG and condensate, which are sold in the local markets.

In August 2017, Pearl Petroleum reached a full and final settlement with the KRG of the arbitration between them, including settlement of past receivables and committing to expand their investment and operations in the region. These expansion plans include the multi-well drilling program currently underway in both the Khor Mor & Chemchemal fields, as well as installation of additional gas processing and liquids extraction facilities. The fields are operated jointly by Crescent Petroleum and Dana Gas on behalf of Pearl Petroleum.

Total investment in the Kurdistan Gas Project to date exceeds $1.6 billion, with total cumulative production of over 260 million barrels of oil equivalent (boe), delivering billions of dollars in fuel cost savings and wider economic benefits for the Kurdistan Region and Iraq as a whole. That impact will continue to grow as production capacity expands in the coming years.

Dr. Ashti Hawrami, Minister of Natural Resources of the Kurdistan Regional Government (KRG) said:

“This agreement is an important step for us as we deliver improved services to the people of the Kurdistan Region of Iraq through enhanced electricity generation from the increase in gas production by the Consortium. The Kurdistan Region holds significant reserves of gas and the KRG is committed to playing a positive role in the growing gas and electricity needs of Iraq and the region.”

Mr. Majid Jafar, CEO of Crescent Petroleum and Board Managing Director of Dana Gas, commented:

“This gas sales agreement opens a new chapter in the expansion of the Kurdistan Gas Project that will see a further investment of over $700 million in coming years to expand production up to 900 MMscf/day, further fueling the Region’s economic growth and development. We look forward to developing the significant resources from these important fields, for the benefit of the Kurdistan Region and all of Iraq.”

Dr. Patrick Allman-Ward, CEO of Dana Gas, added:

“Dana Gas and our partners in Pearl Petroleum are particularly proud to be investing further in the gas sector of the Kurdistan Region of Iraq, delivering a reliable source of cleaner energy, and supporting local economic development. The continuing receipt of payments in a timely manner gives confidence for our continued investment commitment as we enter our second decade of production.”

As part of its work in the KRI, Pearl has implemented a corporate social responsibility program to support local communities, including providing school supplies, drinking water treatment, generators and fuel enabling 24-hour electricity for local villages, mobile medical units, and youth sports facilities, as well as financial support for 1,000 orphans from the Chemchemal area in partnership with a local charity Foundation.

These initiatives are assisting the local communities in improving their standard of living, health, well-being, security and stability and the development of human capital.

(Source: Dana Gas)