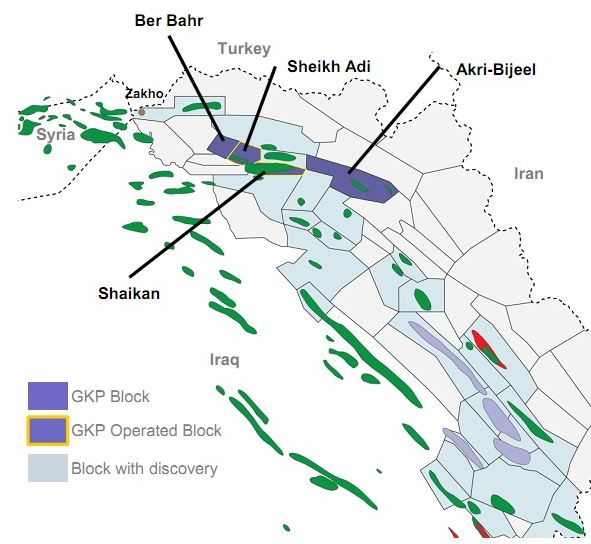

Shares in Gulf Keystone Petroleum (GKP), operator of the Shaikan Field in the Kurdistan Region of Iraq, closed up more than 4 percent on Wednesday following the announcement of its results for the year ended 31 December 2017.

Highlights to 31 December 2017 and post reporting period

Operational

- Strong safety performance during 2017; 3 million man-hours without a Lost Time Incident achieved.

- Average gross production of 35,298 barrels of oil per day (“bopd”) – in the middle of 32,000-38,000 bopd guidance for the year.

- Plant uptime of 99% in 2017.

- Shaikan production for Q1 2018 averaged 31,588 bopd.

- Gross production guidance for 2018 is set at 27,000-32,000 bopd.

Financial

- Signing of the Crude Oil Sales Agreement, which was announced in January 2018, represents a key milestone for the Company.

- Moved to a more transparent invoicing mechanism with the MNR; payment now linked to international oil price and total production at Shaikan.

- Profit for the first time since entry to Kurdistan – net profit of $14.1 million (2016: net loss of $17.4 million).

- Revenue of $172 million (2016: $194 million).

- The cash component of revenue increased by 28% to $157 million from $122 million in 2016.

- Positive cash flow driven by steady operating activities, payments from KRG and limited investment.

- 11 payments received during 2017 from the KRG amounting to $132 million net (2016: $114 million net to GKP).

- Cash balance of $160 million as at 31 December 2017 (2016: $93 million).

- Continued cost optimisation, with additional initiatives to lower costs achieved against stable production.

- Reduction of operating costs per barrel year-on-year to $2.8/bbl (2016: $3.5/bbl).

- Further reduction of G&A to $21.3 million from $25.5 million in 2016.

- GKP has received payments in Q1 2018 from the KRG totalling $75.1 million gross ($59.3 million net).

- Robust financial position as at 10 April 2018, with cash balance of $203 million against $100 million of debt.

Corporate developments

- Jaap Huijskes assumes the role of Non-Executive Chairman, as of today.

- Updated KPIs were introduced in 2017, as part of GKP’s continued efforts to achieve high standards of corporate governance.

Outlook

- The Crude Oil Sales Agreement is an important commercial event and moves the business closer to finalising commercial negotiations with the MNR

- Subject to finalising certain commercial and contractual matters, the Company is ready to resume investment into Shaikan in 2018.

Jón Ferrier, Gulf Keystone’s Chief Executive Officer, said:

“We are pleased to have reported a net profit for the year of $14.1 million, compared with a net loss of $17.4 million in 2016. We made considerable commercial progress during the year and into 2018, with the signing of the Shaikan Crude Oil Sales Agreement being a key milestone for the Company.

“We were pleased to achieve average gross production of 35,298 bopd at Shaikan, in the middle of our target guidance of 32,000-38,000 bopd for 2017. We are confident that once we are able to restart investment into Shaikan we will be able to lift production towards our near-term target of 55,000 bopd, a step towards the full field development.

“I would like to thank our shareholders for their support, our hosts the Kurdistan Region of Iraq, and all Gulf Keystone employees, for their commitment and professionalism during 2017. I would also like to welcome our incoming new Chairman, Jaap Huijskes, and reiterate our thanks to his predecessor, Keith Lough.“

More here.

(Sources: GKP, Yahoo)