Abu Dhabi National Energy Company PJSC (TAQA) has announced that its subsidiary, TAQA Atrush B.V. (TAQA Iraq), has set a new production record from the Atrush oil field in the Kurdistan Region of Iraq.

For the first time since the field commenced production operations in July 2017, the total monthly production volume exceeded 1 million barrels of oil in July 2019.

The 1 million barrel mark is a key milestone in TAQA Iraq’s ongoing production improvement and expansion plans for the Atrush block and is a testimony to the effort, professionalism, and commitment to deliver safe and efficient operations in Iraq.

The current rate of gross production at the Atrush block is approximately 34,000 barrels of oil per day, which is line with the company’s targets for Q2 2019. The increase in production was largely due to new wells coming on stream and the impact of de-bottlenecking work over the past few months, which has increased the capacity of volumes handled by the production facility.

The facility has continued to meet targets at minimal spend and is a result of a focus on integrated planning and optimization.

Speaking on the milestone, TAQA Chief Executive Officer Saeed Al Dhaheri said:

“This significant achievement is a direct result of our Iraq team’s technical expertise and strategic planning efforts. As a global energy player with operations spanning four continents, our operations in Iraq have allowed us to strengthen our expertise as a leading developer of greenfield projects.

“We look forward to building on this achievement to continue to deliver energy to our strategic partners in the Kurdistan region, and to continue to forge strong relationships with local communities around the Atrush block.”

AbdulKhaliq Al Ameri, Managing Director of TAQA Iraq, added:

“Our focus for the past two years has been to improve the value of our asset while ensuring cost-optimization and uphold our commitment to health and safety. I am particularly proud of our team, which comprises more than 300 people, many of whom are from the Kurdistan region. This achievement is a result of their hard work and dedication to TAQA’s vision.”

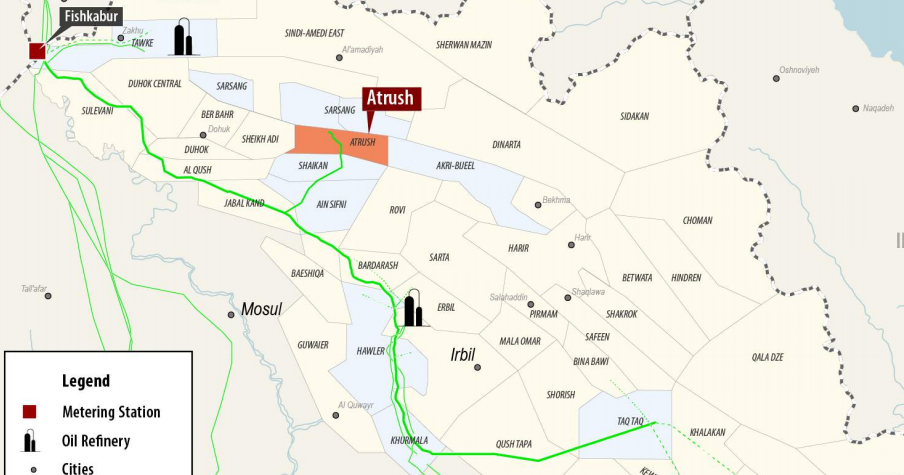

The Atrush field is located 85 km northwest of Erbil and is one of the largest new oil developments in the Kurdistan Region of Iraq. The field was first discovered in 2011 and production started in 2017. In its two years of production, the Atrush field has produced of 17 million barrels of oil, with increasing efficiency.

In May 2019, TAQA Iraq completed the acquisition of an additional 7.5% working interest in the Atrush block from Marathon Oil KDV B.V. With this acquisition, TAQA Iraq’s working interest in the Atrush block increased from 39.9% to 47.4% and represents an AED 116 million addition to the company’s assets.

TAQA Iraq is the operator of the Atrush block and has a 47.4% working interest under the Atrush block Production Sharing Contract. TAQA Iraq’s partners in the project are the Kurdistan Regional Government (25%) and General Explorations Partners, Inc. (27.6%).

(Source: TAQA)